3 Keys to Getting the Best Home Investment Program

3 Keys to Getting the Best Home Investment Program

Today there are several different stock programs on the market which will generate analytically picked stocks which are set to go and profitable trends so that you can invest accordingly without needing the experience or time to invest yourself. These programs are modeled after programs which professional traders use to anticipate market data but are available on a home based scale.

All you’ve got to do is invest in the corresponding picks which they generate to make reliable money. Not every home investment program is as good as the next, so here’s what to look for to get the best stock program for the money.

First, look for the home investment program you go with to focus entirely on cheap stocks. Penny stocks perform with much more volatility than greater priced stocks as it takes virtually little trading influence and send them skyrocketing value. Some home investment programs exclusively target cheap stocks for this reason, because if you can find a cheap stock which is set to go on a profitable jump you can make far more money on it than an initially greater valued stock.

Next, go with a home investment program with a money back guarantee on it. Most importantly for the reason for doing this is the fact that it enables you to test the program first hand. This entails getting the program, receiving a handful stock picks, and following their performances along in the market accordingly. I’ve done this with every home investment program I’ve ever used and find it to be the best indication of whether or not this program is worth your money.

You can also check out a user review site or two to learn a thing about the most popular, not to mention the least popular, stock programs on the market. You can learn interesting insights about these programs which you likely never learn from the publisher themselves.…

How to Make US Government Spending Habits Work Toward Your Investing Process

How to Make US Government Spending Habits Work Toward Your Investing Process

We are better than most world economies only because we are sinking slower. We are however still going under. I see the direction of the U.S. government as something we, as its citizens better off not fighting but joining.

Here are some musings/observations about our economy that we as investors can use to our benefit.

1. There is no reward for savers anymore. We punish people who do everything right. Savers earn nothing on their bank deposits, and the purchasing power of their savings falls further every day. When the interest rates are lower than the rate of inflation, simply saving or investing in low risk instruments such as treasury or municipal bonds doesn’t work.

2. The Government DOES however reward indebtedness. My financial plan now includes going into as much debt as I can. The Government rewards people who take on more debt than they can manage. I watch people who haven’t made a mortgage payment in years and still live in their house, which never gets foreclosed.

3. The Government devalues our money by printing more whenever it’s convenient to cover its ever increasing debt. Therefore what seems like a large amount of money today will amount to nothing in the future with the inflation of the dollar.

4. Many Americans believe they are entitled to something. The lower income populations feel entitled to Government handouts and the rich are entitled to lower taxes than the rest of us. Middle income people pay the fare and don’t expect rewards.

5. Government insurance of banks assures them they can’t fail, no matter how many bad loans they make. We created a penalty-free environment for stupidity. Use this to your advantage.

You’ll lose when you play against the Government. Don’t play against the Government, play with them. Don’t work hard to pay off debt. If you really want to go all the way, skip a few house payments every year, and invest that money.

Before you start skipping house payments however, be sure to refinance your house and get as much equity out of it as you can. Remember, the Government doesn’t reward you for having equity in your house. You don’t get to deduct anything on your taxes for home equity, but you can deduct a second mortgage interest.

Once you’ve borrowed to the limit at long term and low interest, pay back the loan with as little of the principle as you can manage. If you can get an interest-only loan, all the better. If you can get a thirty year loan at under 3% interest, you’ve got the best of all worlds.

The plan is to pay back as little principle as possible. Emulate your role model, the U.S. Government. After 30 more years of inflation, the annual income of the average household will be $500,000 a year.

If you managed to borrow a half million dollars during that time for example, go ahead and pay it back. It will be like having a $50,000 loan today. It’ll be chump change. Retire the loan and thank the Government for the continued devaluation of the dollar.

You could invest the principle for 30 years and get rich using their policies, while paying practically nothing for the money. This is my retirement plan. Imitation is the sincerest form of flattery.…

5 Necessary Advice for Investors In Stock Trading

5 Necessary Advice for Investors In Stock Trading

Investing in the Internet is a new huge trend and it’s worth to know for beginners some basics. So, I would like you to have a look at the following stock trading advice for the novices.

I need to say, the people who want to be involved in stock trading need to know much. This is the knowledge about different situations on the market, security of types of trades. Of course, nobody is perfect about it. But certainly some tips exist about making the inputs more beneficial

Where Should You Invest

Today so many sites exist for online trading, such as TradeKing, E-Trade, Scottrade. All of them may be used by newbie for advice and they help to find a brokerage firm with attractive rates of commissions. These sites also have free courses and important tips for successful trading. Plus they may offer deals, as free accounts for trading for a special gap of time.

The Investment Advice: Learn the Basics.

The Ropes for novice investors is understanding the utilities and the operations in trades. The basis orders, fro example stop-loss and limit and other more complicated operations are available.

Initial Tools for Stock Trading

Learning the stops and limits are vital for successful trades on the initial stages. Direct purchases and sells or orders they all require permanent watch, however other exchanges let investors to make safe nets for purchases and sells that helps to create better trading. And it doesn’t have to be viewed all the time.

Making Inputs to Learn Trades and Orders

The novices in investment have to practice to use the limit of stop orders and will make fell free to invest. Free trades are available at and at related sites. Though, real trades are to help newbie to understand the importance of trades and real risk.

A good experience may be received through handling small amounts of money. One of the clues to success in trading is the low buying and higher sale that is attained by variability in a security. Novice in investment can use the tools at online companies and it will help them to be good at trading.

Looking for Indicators

There are indicators that can aid the investors to foresee the next move according to the security. But it doesn’t give the whole picture, as there exist different techniques to make an analysis of the presented course within the particular time. The tips here are: days of success or raising/falling tendency of the market.

The above mentioned tips and advice can undoubtedly help newbie in investment to understand the mechanism and tendencies in order to gain a return from that. First, they need to choose a good site, study the orders, search for potential indicators and then practice, of course. That will help a new investor make a notable progress in his online trading.…

Easy Tips to Start Investing Tomorrow

Easy Tips to Start Investing Tomorrow

Most people know that they should invest their money. Over time, well thought out investments can out-perform most simple savings accounts. But the idea of actually starting an investment can be paralyzing.

What should you invest in?

How much money should you invest?

Where do you even start?

First things first – do you have a broker?

A broker is a person or institution which facilitates the sale and purchase of investment vehicles such as equities (stock) or mutual funds. Now, if you’re just starting out, you’re probably not going to get much interest from the big investment firms. Instead, consider using a simple online discount brokerage. The fees are generally smaller and the initial monetary commitment that is required is lower.

After you’ve set yourself up with a broker, you need to transfer money into the brokerage. How much you start with is entirely up to you – but remember, many brokerages will have a minimum amount that is required to open an account. When you first start investing, it’s often easiest to begin with the minimum amount and contribute more as you grow more comfortable.

Next comes the tough part – what do you invest in?

When you’re first starting to invest, there are generally two options that people consider: equities or funds. Equities generally refer to the purchase of stock while funds, such as mutual funds or ETFs, refer to collections of investment vehicles, some of which may be equities. While the choice is yours and you should certainly research it further, most people often find it easiest to start investing in mutual funds or ETFs because it gives them exposure to many companies at once, rather than taking a risk on a single stock pick.

Then – just get started and make a purchase! While some people might feel tempted to wait for the “best” price, in reality, no one can predict what the economy will do with 100 percent accuracy. You might not get the best price, the stock might go down, and it might go up – but as long as you intend on holding it for the long term, you’ll be able to weather the storm. In fact, many people find it advantageous to contribute regularly to their investments. Over the course of a year, this “averages” your purchase cost – at times you’ll pay the best price and at times you’ll pay the worst, but on average, you pay something in the middle.

Finally, always remember that a simple savings account is an investment as well.

It’s a very conservative investment and it won’t make you a huge amount of money, but if you are uncertain of how to proceed, it’s never a bad idea to simply stash that money away in a savings account.…

What Is an Investment?

What Is an “Investment”?

Investing or the making of an investment cannot be confined simply to the world of economics and finance. While it is true that it is most commonly seem in that frame of reference, it is broader and is actually a part of every person’s life.

Investment, as I like to define it, is the act of putting effort into something now in the hopes of getting a return later. It can be almost ANYTHING – time is a very common investment. Take fitness, for example: you put in time at the gym now, so that you end up with a healthier body and better physique later. In a sense, as I write in my blog, you are trading time now for more time later.

There are hundreds of types of investments. From stocks, bonds, and mutual funds (and all of the types in each), to government investment in military or infrastructure. The list is essentially never-ending. But these are not the type that matter most, though I do find them an essential part of financial security and freedom. Examples of investment outside of the markets or government often include investing your time in another person, – much like Multi-Level Marketing (MLM), or the way businesses often use franchises – investing time and effort into cultivating your intellect, or investing money in a toy, movie, book or other item that will bring you some sort of happiness. The reality of the situation is, a large portion of the things we do are technically investments, and the return on investment is simply our incentive. And, as I hope we are all aware, incentives drive the world, and drive 99% of everything you or I do.

So whether it is your goal to lose 60 pounds this year, or whether you want to start your own network of multi-level marketers, remember that you’re making an investment. That knowledge alone will give you an extra incentive to work hard to achieve your goal.

On an ending note, look for articles or blog posts in the future to learn in detail about each type of investment. And learn to expect that no matter what, if someone is putting time in to something, they want to see something out of it. So maybe, just maybe, learn to be a skeptic and not always trust that a friend or co-worker’s motivation for helping is completely pure. Because, well, it MIGHT not be.…

Reasons and Benefits of Doing Business in Thailand

Reasons and Benefits of Doing Business in Thailand

Known as the Land of Smiles, Thailand is country of exquisite beauty, historical treasures and hospitable people. The incredible natural beauty, the world-class cuisine, tropical climate and relaxed lifestyle are some of the major reasons to start a new business in Thailand. Starting your own business in Thailand is the best way to enjoy the enamored lifestyle and earn a comfortable living in the Kingdom. Thailand is the second largest economy in the 10-nation ASEAN. The nation is rich in natural resources, such as timber, rice and precious stones. Textile, jewelry, tourism and electronic appliances are also some of the bigger players that add to the GDP of the nation. Starting up a business in this country is not a straightforward process. In order to run business successfully in this country, there are several important issues to be taken in consideration.

How to start a business in Thailand:

According to the Foreign Business Act (FBA), Thai government restricts business categories for foreigners. (Except for U.S. citizens who can engage in the business under the same rules as Thai nationals – Thai treaty of Amity). The foreigners are restricted from engaging in some business categories, unless a permit is obtained.

The most common way to initiate a new business venture in the country is by having a partnership with a Thai citizen. The labor, immigration and foreign investment laws are quite complex in Thailand, and hence a foreigner or alien cannot take part in day-to-day activities of business and requires a Thai national partner to run the front part. One can also think of opening a limited company in Thailand, but just remember, the Thai government restricts foreign investment in industries, like banking, transportation and communications. All the company documents are to be filed in Thai language and one may require professional help. The foreign owner shareholders can have only 49% and 51% is given to the Thai shareholder.

Benefits of starting new business in Thailand:

Thailand is considered as one of the region’s most attractive foreign investment destination. Thai government offers many incentives to the foreign investors. Incentives include tax exemptions and other generous concessions, permission to own land and import duty exemptions. However, foreigners are not allowed outright ownership of land.

Foreign Business Act is the main governing body that outlines the types and categories of businesses open to foreigners. It also sets the laws and regulations and restrictions for specific sectors such as insurance business, real estate and financial institutional businesses. To run your business successfully in this country, you require knowledge about the country’s Foreign Business Act, legal system and tax laws.

Unlike most of the other countries where it takes 38 days to start up a business, it takes on an average 33 days to start the business. Manual labor and construction is very affordable here as compared to other nations. The large, adaptable and intelligent workforce increases the potential for development and success of business. This regional center for trade and manufacturing has become an attractive place for doing business.…

How to Plan for Unexpected Expenses When Running a Business

It sounds ironic to plan for the unexpected. But, in business, it could mean the difference between surviving or failing in the event of an unplanned situation.

As a business, you are bound to face unexpected expenses from time to time and it’s necessary to prepare for them. It could be anything from equipment repairs to sudden opportunities that require additional capital you may not have planned.

Whatever the case is, the first step to prepare for the situation is to be in a solid financial state. In this article, we’ll discuss further how you can build an emergency fund.

Protect Your Business From Unexpected Expenses With These Tips

- Build up an emergency fund.

An emergency fund is usually a few months of expenses in the bank for your business. It’s like a rainy day fund which you set aside for when emergency expenses occur. These include:

- Equipment breakdowns

- Utility problems; and

- Unprecedented business growth

Having an emergency fund provides a sense of security that you have enough funds to tide you over in lean times. It also means having enough money when the need arises without resorting to other options such as borrowing money with high-interest rates or tapping your personal funds.

- Track your expenses

Make it a habit to account for everything you spend.

Start by listing your fixed expenses: lease, taxes, insurance, and payroll. Then look at your financial history in the past year, along with your bank and credit card statements to identify the irregular expenses you have paid.

Tally up the amount and whatever is above your regular expenses, factor it in when calculating your emergency fund.

- Cut back expenses where possible

Aside from saving money, also prioritise cutting down your expenses. Review your finances—cancel subscriptions you haven’t used in a while (e.g. SaaS tools you no longer need) and shop around for better rates.

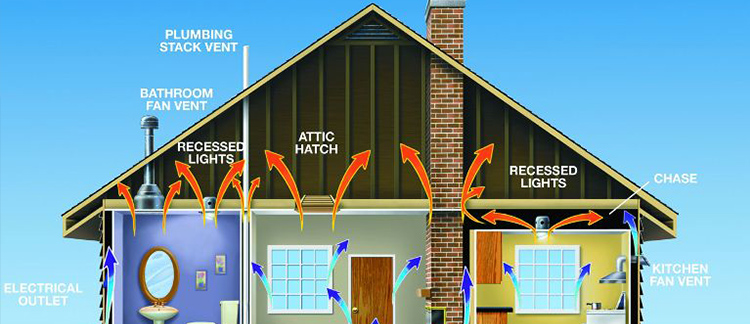

It is also where prioritising preventive maintenance and repairs matters. When detected early, you can address issues quickly, for the less amount you would pay for emergency repairs. It shows that while paying for maintenance may seem counterintuitive, it sure can keep your equipment and utilities in good shape, saving you a lot of money and headaches in the long run.

- Plan Ahead

Concerning the above point, it makes sense to plan for the events that are bound to happen in your business. You cannot accurately consider an equipment breakdown as an emergency expense when maintaining it to prevent such serious issues is one of the responsibilities of running a business.

Protecting your business from unexpected expenses mostly boils down to planning for things that could go wrong. Anticipate them and build up a decent emergency fund—you should be fine.

- Build Your Credit Score

Even with an emergency fund, there will come a time when you will have to borrow money to get started.

Having a high credit score can do several things, the most important of which is proving to the bank that your company has good financial records and is trustworthy. The interest rate on your loans could also be lower. Some of the ways to improve your credit score are as follows:

- Pay your bills on time

- Pay off your debt and keep your credit card balances low

- Do not close unused credit cards

- Apply for a new credit account only as needed

Takeaway

Running a business can catch you off-guard when things don’t go as planned. But, don’t let unforeseen expenses get in the way of your success.

Find a financial modelling company that offers consulting services and financial forecasts and projections to help you create a budget that accounts for unexpected expenses. They can also assist you in implementing strategies to reduce your expenses and further fuel your growth.

Get professional advice on unexpected business costs today.

…

The Frenzy Behind Online Stock Trading

The Frenzy Behind Online Stock Trading

Markets dealing in shares and stocks are considered as liquid, supporting and driving the viscosity and density probability factors at a given period of time. Therefore, an investor runs the risk of incurring loss in trading if he/she is not updated with the ongoing market dynamics.

Online trading is an exciting new way of trading in the stock markets in India, and the rest of the market in the world for that matter. Online trading exposes the user to numerous options that leads to efficient and effective result of the investor’s trade. This is the way to ensure better market access, high-speed transactions, etc.

There are number of strategies that are meant for online stock trading in India. The main benefit of online trading is easy money. Another attractive points of online trading is that trader can trade in each and every type of security such as IPOs, bonds and mutual funds.

Thanks to online platform, an investor can keep himself/herself informed by way of collecting the required information on all the topics associated with stock analysis and research. Other than that, an investor or trader is also able to get help by seeking expert views that are again based on stock market and the desired shares. Other than that, traders receive real time information for carrying out trades, something which is unavailable while conducting live trade. This information includes market watch on particular stocks, stock graphs and charts, etc. Orders can also be placed via phones even if you are offline.

Indian stock market is considered as one of the biggest stock trading markets in the continent of Asia. With the help of a consistently high GDP as well as a dynamic and buoyant economy, India is continually outgrowing other economies in this region. And with the advent of online stock trading, the trading in Indian market has become all the more convenient.

In India, for carrying out online stock trading or any online investment, you need to open an online trading and demat account. For all those who are not informed about demat account, it refers to dematerialization account. It is meant for holding the securities electronically instead of holding it physically. The functioning of a Demat account resembles that of a bank account. All the buying and selling of shares are also adjusted in this account.

However, in case you wish to carry out online trading of stocks and that too in a cost-effective manner, you are expected to have clean credit track record, a pre-requisite of opening an online trading and demat account. Other than that, it is advisable to rope in a financial adviser while figuring out a trading or investment pattern, something which is important for efficient channelization of your money.…

Characteristics of a Victorious Real Estate Investor

Characteristics of a Victorious Real Estate Investor

To become a successful real estate investor one must have the capability to identify good real estate deals and invest in them. You should also be able to assess the true value of properties based on when you expect to sell. Your purchase must be made at a reasonably low price to allow for a profitable sale at a later date.

Real estate investing is a strange type of profession that has no accepted curriculum of formal training. The only way to learn the art of successful art of investing in real estate answer is for you to find a mentor who can teach you the secret formula. You must become an adept at appraising and finding out the true value of a property as this information is critical to make an informed investment decisions. Realtors, appraisers, and banks determine what a property is worth by studying recent comparable sales in the same neighborhood. You must be able to do the same.

Leveraging is key factor for investors in real estate because the less cash you part with on each transaction, the more properties you can buy with your total available money. If you are long-term investor, leveraging will work in your favor if the markets in which you invest appreciate in the long run and your income from the properties can pay for most of your monthly debt.

Exit strategies are also equally crucial to successful investing. As a real estate investor you must know exactly when to sell the property even as you buy. You must completely study the market and your work out your plan even before you invest. Real estate investors can help you interpret market indicators such as the average length of time houses have been on the market. This information it will help you make better investment decisions.

Successful investors make it a point to review their portfolios at least once a quarter and work aggressively to get rid of the losing properties before they can seriously erode the profits from their winners. Bestow enough attention to protect your properties from creditors, plaintiffs, and the taxman. It is no doubt complicated, and time consuming – but yet every successful investor takes the time to do it, thus assuring that their hard-earned money is not imperiled.

To succeed in real estate investing, you must cultivate the art of moving with people as the business is built around people – sellers, tenants, contractors, agents, financiers etc. Since there is no written code of ethics for investors, it is up to each investor to decide how he will deal with customers, tenants, sellers, workers etc.

Do your market research thoroughly and look at houses that are priced lower than comparable properties in the neighborhood. Purchase the property with the lowest possible cash down-payment and get the seller to carry back a second mortgage or deed of trust for the property. If you can get a low enough price and generous terms you can make almost any property into a successful investment.

Finally, one last important rule for investing in real estate is – do not become sentimental about a property that you are purchasing for investment. Always look at the property from the viewpoint of a critical purchaser and a businesslike investor.…

How Stock Market Trading Happens

How Stock Market Trading Happens

The stock market has puzzled many people over the years with its behavior. Not many so called analysts have been able to make predictions that are always right and that is because price movement of stocks are dependent on a variety of factors like political developments, economic news, company performance of the stock, influence of foreign institutional buying and so on. In short, it is just another market that behaves as per the demand and supply existing at a particular point in time. It can be compared to a big super mall where people are either buying or selling stocks. For every buyer, there is a seller and vice versa.

This transaction of buying and selling of stocks is facilitated by a stock exchange. The New York Stock Exchange is one such example. As compared to earlier times, when you had to be physically present at the exchange to trade stocks, modern trading is done through online trading portals that are owned by brokers and many people have been able to do so from the comfort of their homes.

Let us look at one example of how a stock trade happens.

You first need to open a trading account with a broker and also a deposit amount with which you can trade in a specific quantity of shares depending on the price of the stock you wish to trade in. You then place an order to buy a particular stock at a particular price and the quantity could be say 100. The trading platform will communicate to all networks that somebody wants to buy 100 shares of a particular company and this immediately results in an interested seller of that stock to make available 100 shares at the price you wanted and the transaction is done online. Hundred shares get transferred from the seller’s account to your account.

Several such trades keep happening through the working hours of the stock exchange on a daily basis and the relevant brokerage fee; taxes to the government and so on are all adjusted online in the trade that is executed.

Now the decision of what stock to buy is based on valuation of the stock and that is determined by the profits the company is generating, the future potential of the company or the industry and the time the buyer is willing to remain invested in that stock. Those are aspects that merit discussion separately.…

Property Management Tips For Investment Property Owners

Property Management Tips For Investment Property Owners

Property management knowledge and experience is very important when it comes to managing the properties that are in your portfolio. The care and attention that a property manager takes with an investment property can make a huge difference to the success of an investment property.

If a property manager is careless with the management there are several things that can happen, some of which are listed below:

1. Rents will start to accrue and will be difficult to recover, even to the point where there may have to be legal proceedings

2. Tenants damage the property

3. Maintenance is not kept up to date and over time what would have been ‘repairs’ become ‘replacements’ which is a much more expensive exercise

4. Rents are not achieving full potential because the property is not as attractive and competitive as others on the market due to it looking ‘tired’

5. There is major damage to the property and tenants are not removed promptly

So to ensure that your property will be managed properly here are some tips:

1. Research the area and find out where the good property management teams are. Speak to them and interview them to find out exactly what services they offer and what charges they make.

2. Check that they send you monthly reports on the property and three monthly inspection reports. In this day and age there is no excuse that they cannot take dated photos to send to you.

3. Tell them that you would like to inspect the property with them at least once a year so that you can personally keep updated.

4. Discuss with your property manager your purpose for owning this property as regards cash flow, costs, future goals (rehabbing or freshening up between tenants, etc) so that they know exactly how you want the property managed.

5. If you find that you cannot get the satisfaction you want from a property management team do not hesitate to finish with them. Before you do though, make sure that it has not just been poor communication that has caused the problem and one which can be fixed quite easily.

As a property investor you are in the business of property investing to make money so you do need to take responsibility of the running of it as a business. You need to treat the property manager as an extension of your business and ensure that there is good and frequent communication between both parties. Don’t do as I have heard being done, not make contact then 12 months later wonder why everything is not going as well as it should be. Insist on those reports and make sure that you are reading them and giving them the tick of approval.…

Diverse Types of Investing

Diverse Types of Investing

There are many investment types that you can begin your quest of investing in. Stocks, and bonds are some of the more typical ones that you can invest in. The only thing complicated about them are the sub brackets that fall under these investment types.

The stock market is one of the scariest places for people to invest in because of the high risk involved. There are three types of investors: Conservative, moderate and aggressive. The different types of investments all have their place in each one these investor prototypes.

Most conservative investors invest in Currencies or in options in the stock market. This basically means that conservative investors invest in money market accounts, CDs, and T-bills. These are the safest investments to make over a long period of time with low risk involved.

A more moderate investor invests in bonds and currencies as well. They may invest a portion in the stock market here and there. They may also invest in real estate that have low risk involved in them as well.

Aggressive investors are more involved in the stock market, which have higher risk. They will invest in other investment vehicles such as real estate like apartment buildings, rehab properties, expecting to get a lot of money in return from the rents of the apartments and rehab properties. They may even sell the property all together. The risk is that they may not sell the property as fast as they would like.

Before you try to dive into an investment vehicle, you should do more research on the many types of investing so you can get a good idea of how you fit into the vehicle as well as the risk involved. Pay attention to consistencies, trends and other forms of history that repeat themselves.…

American Debt: How Did It Come To This?

American Debt: How Did It Come To This?

The American debt, namely the total amount of money the federal government owes (including the deficit and the interest on borrowed money) is of circa $13 trillion this year, and is increasing at a fast rate. Out of this huge sum of money, some $8 trillion is owed to bond mutual funds and foreign governments, that is, to those that bought US governmental bonds, and the rest of $5 trillion to government trust funds such as Medicare and social security. But despite the fact the US owe a staggering half of trillion dollars to Japan and another half to the United Kingdom and China, most part of the national debt, namely 78%, is owed to domestic businesses and government entities. Has a whole nation deceived itself? Well, some lost big and some won big, but in the end everyone lost. Paradoxically, this is the truth.

Citizens have been encouraged to live on credit for decades, but that was fine as far as people could finally settle their debt; and they had to, if they wanted to borrow again as they were used to. But this habit became catastrophic with the real estate bubble. In less than a decade (1997-2006), the price of an average house had increased by 124%. Encouraged by these developments, a lot of owners refinanced their houses at lower interest rates, taking out a second mortgage based on the price increase. What they did with the money so easily earned? That’s simple: they spent it; only between 2001 and 2005 the refinancing money spent had doubled. But they have never thought that house prices could go down, credits could be impossible to obtain and mortgages to pay off and, therefore, that their properties would eventually be foreclosed by banks. But that’s exactly what happened.

And this was still only the tip of the iceberg. These prime borrowers had at least something to lose in favor of the crediting banks. But with the sub-prime credits granted to people that presented high risk of default (2004-2006), the banks remained completely exposed. And, as expected, they lost, and lost big. Besides, the bubble was over and house prices went down. Few could afford to buy them even so. So, at best, banks remained with a lot of houses they couldn’t sell. The question is how was such substantial crediting without the right securities possible in the first place? If the borrowers, just normal citizens, without sophisticated financial knowledge were unconsciously getting more and more indebted, what happened with the lenders – major banks – expert in financial intricacies? Why should they doom themselves to bankruptcy, lending unconsciously, at random?

Well, believe or not, exactly the government and the banks encouraged, if not generated the indebtedness, by financial deregulation, changed laws, poor financial enforcement, off-balance financing and elaborate financial creations such as derivatives, CDOs, CDSs, MBSs and other such. When regulators themselves come with tricks for circumventing the laws, there is no surprise that not only the common citizen loses but also those that weakened the laws. In these conditions, the $700 billion amount used by the government to rescue the banks that caused this havoc in the first place does nothing but confirms the self-deception scenario. In this way, all have become deeply indebted: citizens, the banks and the federal government. The paradox has been unraveled.

Possible solutions would be less government and consumer spending, more production and, of course, investment in reliable assets (definitely not houses), which warrant gains. So, if you still have money, buy gold!…

Owning Physical Gold – The Ultimate Safe Haven

Owning Physical Gold – The Ultimate Safe Haven

Paper currencies have come and gone throughout history, only gold has maintained its place on the market and has always been on top. At the same time, gold is the oldest form of money and people have used it in trades, businesses and so on since its special qualities have been discovered. As other currencies, the yellow metal has faced some ups and down, however in comparison with paper currency gold has increased intensively when the inflation took off in the 1970s.

With stock markets at record lows, banks closing and government bailouts on the rise due to the critical times we live in today`s world, people started looking for viable forms of investment. Gold proved to be as both viable and durable investment on the present market. While there are many forms of investment such as shares, virtual metal and so on, buying gold in physical bars or coins is not only safe haven, more, with a wise decision.

The reasons why to own physical gold are numerous, starting with the fact that the yellow metal holds its value for a long time, it`s price generally increases at a greater rate over the long term, while paper money or other types of investment usually don`t. In the last decade, gold has reached a high price for over 1,200 pounds and it will probably stay as this for quite some time compared with the dollar that has brought the world terrible financial crisis.

Another strong reason for which you should consider buying gold is that by owning and keeping it in physical form in your possession, you will still be able to purchase consumables with it in case your economies were to disappear overnight. The precious metal will remain strong in times of recession and as a proof in the past couple of years successful businessmen but also, ordinary citizens, have chosen this form of investment.

Owning physical gold means you have to safely store it in your home, or if you buy a substantial amount is better to keep it in a safe vault in a bank or private gold dealers. As a conclusion, the precious metal is seen as a safe haven because its price tends to rise when equities are falling and as a result your gold holdings should increase in value. Experts affirmed that those who bought gold in 2009 can reach a profit up to 30 percent if they sell it this year. So not only it preserves the wealth but it can also bring you a lot of profit.…

Five Tips For Buying a Rural Property

Five Tips For Buying a Rural Property

If you have decided to buy an investment property in the country then there are a few things you need to be aware of. It is important you understand that life in a rural area is a lot different from suburban or city life, and that although it may look peaceful and quiet, life in the country can be busier than you may expect.

Agricultural industry

When buying a property you need to be aware that agriculture can be a noisy and smelly industry. If you think you will be buying a property away from noise and pollution just because you are in the country then you would be wrong. People working in agriculture use machinery, such as tractors, harvesters and stock trucks, so expect traffic noises. Animals, such as sheep, cattle and chickens, can be quite noisy when there are a lot of them, so look at what type of farm is next door to the property you are interested in. If the sound of roosters crowing at dawn is going to drive you crazy then you might not want to live next door to a chicken farm.

Action

Know what action you can take to improve your property. If you have fallen in love with a property but are turned off by what is over the neighbours fence, then think about what you can do it improve your property. To minimise noise, dust or block out an unsightly neighbouring shed, for example, you can plant windbreaks. A farmer is not usually required to minimise impacts from their agricultural enterprise so be prepared to have paddocks next door turned from lush green grass to a ploughed area, for bushland to be felled for more pasture or for windbreaks to be planted that block your view.

Rural roads

Sharing the road in a rural area is different to sharing a road in the suburbs or city. It is common for stock to be moved along the side of a road, or even across it, and it is your responsibility to give way to livestock. Slow down and be prepared to have to wait. Road surfaces can vary in the country too, with unsealed roads being common. Roads are not always in great condition either, even bitumen roads. There are certainly no street lights either, so be careful driving at night and use your high beams.

Pests

As a rural property owner you are responsible for managing pests on your property, which includes both feral animals and weeds. Rabbits destroy crops and spread disease, and foxes kill many lambs and even newborn calves. Weeds are a major problem and noxious weeds in particular need to be removed.

Services

When buying a property keep in mind that you won’t necessarily have access to services, such as gas, electricity or even a road. Properties a long way out from town often don’t receive a postal service, and a school bus may not go past your front gate either. You are likely to have a septic tank instead of being connected to the sewerage system, and you won’t be connected to town water either and will need rain water tanks for drinking and washing.…

Business Gifts and Who to Give Them to

Business Gifts and Who to Give Them to

Every year companies debate whether or not invest in business gifts and if they do, who they should give them to. Budget plays a large part in the decision making process but it is not the only important consideration. Matching the gift and perceived value to each recipient is extremely difficult even if you know your clients well, let alone if you don’t. The value of the investment made in the gift and the potential return is also something that maybe people don’t like to think about but nevertheless is equally as important.

We give gifts to our family and friends for special occasions and over holiday periods because it is customary for us to do so and we enjoy giving. To some extent it is expected of us because of the commercial hype that has developed over so many years. However, our business associates do not expect us to give them gifts and are usually pleasantly surprised if we do. A big problem arises if we have a huge number of business contacts because not very many companies can afford to give to them all. If they know each other, the problem is magnified because people who don’t receive gifts will be envious of those that do and offended because they didn’t receive one.

As John Lennon once said “there are no problems, only solutions” and this is certainly true of an experienced, professional business gifts supplier. You can make a list of names, placing the most important clients at the top of the list, work out the budget that you can allocate and then have a meeting with your supplier. In the armory of business gifts at his disposal he will be able to advise you on how many gifts he can supply for the money available and if he’s good he’ll be able to provide a gift for everybody. He will have access to personalized bags, clothing, caps, leather products; laser engraved metal pen sets, clocks, watches, backpacks, sports bags, crystal, USBs, umbrellas and so many more items.

You may also want to include some valued customers on your business gifts list together with members of your staff for outstanding achievements. However, tread carefully if you want to use them for new business because that can be a minefield of etiquette. If you are bidding on a contract, giving the decision maker a gift will be seen as a bribe. It would probably never cross your mind to bribe someone but no matter how good your intentions are – don’t do it.

Taking business gifts to a first meeting in China, Japan or Spain will make you very popular but it will be frowned upon in the United States and the UK so if you have international business interests some cultural education will benefit you if you are contemplating first contact business gifts.Every year companies debate whether or not invest in business gifts and if they do, who should they give them to? Budget plays a large part in the decision making process but it is not the only important consideration. Matching the gift and perceived value to each recipient is extremely difficult even if you know your clients well, let alone if you don’t. The value of the investment made in the gift and the potential return is also something that maybe people don’t like to think about but nevertheless is equally as important.…

Personal Accident Insurance: The Advantages Of Having One

With Urbanization reaching new heights, road accidents have increased over the years. Roads have developed and extended to the remote parts of the country. People are quite able to afford their personal vehicle. This development also brings a major problem in the scene, road accidents.

Road accident victims are mostly rushed to the nearest hospital available; it can be private or government. In such situations, one should have all-covering accident plans. Accidental Insurance covers can help in financing all the hospital and medical costs during treatment.

These plans are available in abundance in the market, but you must look for the best. Let us discuss a few reasons as to why buying an Accident Insurance cover can do well for you.

Benefits of Accidental Insurance Plans

Sharing of Financial Burden:

A good Accidental Insurance cover can help you lessen the financial burdens by almost 70%. The insurance company will pay your hospital expenses such as medicines, disability covers, occupational compensation, etc. thus, and it will help you financially and mentally as well.

Affordability:

Personal Accidental Plans are affordable so that every section of society can have access to it. The Accident Plans’ premiums are set based on the financial situation of the beneficiary. The insurance policy is your savings as you will save your money during any undesirable emergency.

Cover for Accidental death:

In some cases of accidents, a person can even end up dead. A good Accidental Plan will provide you a 100% compensation in such a situation. Thus, you are getting the benefits of two things in the money of one. The insurance cover may also compensate for the funeral and repatriation cost.

Hassle-free claim:

If someone is involved in an accident, claiming his insurance is the first worry in his mind. Accidental Insurance Plans provide you with a hassle-free settlement process. There are no prior medical check-ups involved to claim the amount insured. What you need to keep in mind is that you are getting treatment in a hospital included in the company’s network.

Add-on benefits:

The Accidental Insurance Policy may provide some additional benefits other than hospital expenses. A good insurance plan may also fund the education of the dependent child and allow some daily cash benefits. In certain cases, a percentage of the insured sum is offered for the treatment of minor accidents, including fractures and burns.

What to keep in mind:

Before buying an Accidental Insurance cover, one must keep a few things in mind to gain maximum benefits. Make sure that the accident plans that you buy must cover previous injuries and self-inflicted injuries. There are options to opt for either a personal plan or a group plan, or a family plan depending upon needs. Thus, you must reach out to a consultant and discuss your needs.

People should understand the importance of an Accidental Insurance cover and opt for it as soon as possible. An early subscription has its benefits in the long term for the insurer.…

Tell Tale Signs Of A Risky Investment

Tell Tale Signs Of A Risky Investment

When we invest, we want to make money. Its a simple concept but often that simple concept leads to us making some dire investment decisions that not only loses us money but can keep us from investing in the future. Investing, in the right hands can be very powerful and can allow your money to work hard for you. In the wrong hands however, it can be disastrous.

Its said that there are 2 emotions that drive all investment decisions – fear and greed. Fear is what makes us overly cautious while greed is what makes us insufficiently cautious. Expert investors are those who can control these 2 emotions. Can you? Well, we all think we can but when the moment presents itself we often succumb to the temptation of either making too much or risking too much.

the truth is that all investments carry risk. Along with risk comes reward and unless you risk you cannot be rewarded. the key is to take smart and calculated risks. The problem is that greed can easily set in cause horrible investment decisions. Risky investments usually have risk written all over it, but if you are a novice investor its really hard to tell. We’ve all see illegal investment scams catching out the elderly. Why? Because they are usually uneducated and vulnerable.

So, how can you tell is an investment is too risky? Usually if it sounds too good to be true then it is.

– Anything that guarantees your investment 100% is usually a scam.

– Anything where you can not see where your money is being invested is usually a scam.

– Anything that operates from so-called tax havens are usually a scam.

– If the company or investor that’s investing fro you does not have a reputable name that’s been in business for a while, then its probably a scam.

If you do want rapid growth on your money, stick to reputable investment houses and companies that are national. Not only will your investment be more secure but they will probably make much better investments than some private company that has no reputation.…

Understanding The Vital Role Of Strategy In Property Investing

Understanding The Vital Role Of Strategy In Property Investing

One of the areas where a person would be able to discover high profit investment opportunities. However finding success with this industry of investment isn’t a walk in the park since real success often demands strategy, experience and a level of knowledge which most new investors do not possess.

To fully understand what is required from an individual with their opportunity, its essential to understand the role that strategy plays in your profit potential. When you use smart strategy processes when approaching your prospective investment you create a huge opportunity to overcome hurdles and find a profit when you’re seeking the sale of your investments.

Whether you’re a new or an old property investing individual, the first lesson which you will have to learn is that you ought to never develop the habits of blind investing strategy. Several beginners look at property investing as a simple game of buying a property at a low value, fixing it up and selling it high. Whilst this is often the easiest way to describe the investment procedure, a lot more is demanded from an individual trying to find real substantial profits. The blind investment strategy does not often account for several factors that can have an effect on the value of a property or encourage a homeowner to purchase in that area.

When you’re seeking success in property investing its essential to take on the perspective of the buyer in order to understand how they will perceive your home buying opportunity. Even when your home represents the best property available to buyers, your area might be unappealing to the home owner, encouraging them to purchase elsewhere.

Its vital to recognize that property investing goes far beyond the investment into a lone property since it is an investment even into the area surrounding your investment property. Look for areas which are presently growing, promising a bright future, or areas which are ideal to your intended customers. If your property is designed around fulfilling the needs of a young couple or bachelor pad then a location next to a school won’t be perfect.

A similar argument is made when your home is focused on filling the needs of a family yet the property is miles away from schools or local shopping centers. These are all factors that your buyer will consider so its essential that you conduct the same research to increase your property investing opportunity.

When you hope to benefit from the financial opportunities which are available with property investing its vital that you incorporate effective strategy into your planning. The blind investing strategy might work on occasion, however the broad spectrum of opportunity is usually limited.…

Color Me Gold And Call Me Smart!

Color Me Gold And Call Me Smart!

Gold has always been a real fascination for mankind. Since early history, both men and women have loved to embellish their outfits with gold jewelry and accessories. But apart from its beauty, this precious metal has many other characteristics that make it useful in so many fields. People have been using it to make jewelry, coins, but also in dentistry, electronics, chemical industry or photographic processes.

Nowadays, you can also consider gold from another point of view. Even if you are more of a spender than a saver, you should think of putting something aside for rainy days. In times of economic instability, we should all be more careful with our investments. If you are a smart investor, gold can be one of the safest saving methods and also a profitable business. If you are asking yourself what makes gold investment such a smart move, think of the following aspects:

Today’s gold market is stimulated by factors like the growing gold demand in Asia, the falling gold mining output, the instability of the US dollar and the rising inflation. If money can be printed any time, and many governments did so to overcome economic collapse, the quantity of gold is limited and the yellow metal is difficult to obtain.

In times of recession, when markets are fluctuating, a tangible asset is always better to own than stocks and bonds. You can never know how their value will evolve, but if you do a little research on the gold market, you will understand that the price of precious metals is likely to increase substantially in the coming years. Gold has already been going up for almost 5 years and won’t go down unless there is a sudden change in the world’s economy.

Therefore, think of gold as a smart investment strategy that will help you survive in case of financial crisis or market failure. If you are searching for a safe haven for your money reserves, buy gold. Study the market and decide which form of gold investment suits you best. You can buy bullion, big bars, gold futures, gold mine shares, jewelry or e-gold.…

The Effect of Net Operating Income on Commercial Real Estate Valuation

The Effect of Net Operating Income on Commercial Real Estate Valuation

Smart owners and managers of commercial real estate keep a very close eye on the net operating income of their properties because of the high importance that it plays in the direct valuation of their properties. Being that the most common appraisal method is the “income approach”, higher net operating incomes equals higher property values. The reverse is also true.

Conceptually this all make sense to you, but lets take a minute and review the math behind it so you can see how important it really is. Supposing you own a $10,000,000 property, which you purchase with a cap rate of 8%. What would the net operating income be? Using the cap rate equation (% capitalization rate = net operating income/purchase price) or (8% = NOI/$10,000,000), we then solve for net operating income by multiplying $10 million by both sides of equation and we get NOI = $800,000 We also know that NOI = cap rate x purchase price, or purchase price = NOI/cap rate

Now, lets see the effects of changes in the NOI on the valuation or purchase price of the property. Let’s suppose that you increase your NOI by $1,000 during the next year. What effect would it have on the value of the property? Purchase price = $801,000/0.08 = $10,012,500 In other words, by increasing the NOI by $1,000 you increased the property’s value by $12,500. Pretty powerful stuff, huh? Just as a quick rule of thumb and knowing that cap rates will vary, just think of it like this: For every dollar increase in NOI, you increase the value of your property by $10. If you make significant property improvements that result in an increase in occupancy, the increase in valuation can be drastic.

There are still some very good lucrative investment deals out there if you know where to find them. If you need assistance in locating some of these, please visit our website at and leave your contact information so we may respond to your request.…

What Are The Benefits of Investing in Gold? – Some Known Facts

What Are The Benefits of Investing in Gold? – Some Known Facts

A lot of people invest in gold, even though this method of investment takes some of your time and requires research. So the question of what are the benefits of investing in gold are one of the most common inquiries of those who are thinking about investments especially those who are novices when it comes to investments. If you are interested in putting some of your money into added financial support, then being prepared with facts about gold investment will go a long way in helping you choose the right way.

Gold is actually more than an investment. It is a high-priced possession that is more than the cost of money. Hence, gold is simply as good as cash. In some case, it can even have a higher value than your money because it appreciates over time. Buying gold bars, bullion or coins is considered a win-win scenario, unlike other businesses which tend to be risky. Gold and money are equally the same. If you have gold products kept in your safety, then it is worth saying that money is also saved.

Diversity of the Striking Gold

Diversifying is one of the essentials when it comes to building your portfolio. Precious metals, such as gold, are some of the perfect ways to help boost the performance of your overall accounts when it comes to investment, since gold provides stability. There are times when gold prices take a slight dip, but more often than not, especially when the country is experiencing some economic downfall, the prices of gold increase, and what with the ever increasing financial crises of today, gold is really one good form of investment.

The Fear of Economic Downfall

The stock markets are good investments that a lot of people depend on, but these are always affected when the economy falters, thus investors turn to other methods such as gold stocks. Because of the many opportunities that gold offers, investments in these precious metals are the main preferences of people when problems such as low interest rates and low currency values arise. Amidst such situation, what are the benefits of investing in gold that you can get?

Gold price predictions by gold analysts have reported a continued increase and rise in the many years ahead. With these statements from experts, investors who have experienced loss pull out their funds such as the low yielding and poor performance funds from the stock markets and steer towards the attraction that gold investment offers. Investing in gold shares does not only appear attractive, it also has a big potential for excellent rewards.

Inflation and Demand

The price of gold has a big possibility and tendency to go up during times of economic troubles such as inflation, and gold becomes in demand in countries experiencing downfall in their economies. When this happens, the demand for gold increases, thus the prices rise as well. During inflation, a lot of stock holders and investors pull out their money from the markets, and in turn go for assistance that gold provides since gold is not affected by the same pressure that holders experience in selling their stocks.

So ask yourself again, “what are the benefits of investing in gold?” Gold bullions, gold coins and gold bars have long since proven its advantages of being long-term while providing lower risks. This method has greater advantages since the demand for this metal is much higher than the actual supply of gold. With it being a popular method for saving, the metal being nearly indestructible and having a natural ductility and malleability, investors should take a closer look at all these advantages and invest in them.…

Gold 101 – How to Make the Most of the Gold Market?

Gold 101 – How to Make the Most of the Gold Market?

The value and importance of gold has been known to man since time immemorial. The Egyptians with their huge reserves of gold to the modern day countries using gold as a backing to maintain the strength of its individual currency just goes to prove the importance of gold in our everyday lives. Gold has come to be a global currency independent of the factors that generally decide the ups and downs in an economy. The prices of gold is not one that is dictated by any particular country or Government and is an internationally accepted asset, all this together make it an attractive investment option.

In addition to the stocks and shares, gold is an important asset with which one could diversify the portfolio and maximize returns and decrease the overall level of risk. The gold market with its skyward rising graph is surely an attractive investment opportunity and allows to make an investment in an area that is sure to give you good returns. The returns of gold would be steady and consistent and this metal is not going to loose it luster and shine for a long long time to come. Gold is one that is treated as a sound investment from ancient times.

When it comes to gold as an investment option, it is the gold bullion bars and gold coins that come into picture. Once you have decided on making an investment in gold, it is advised to keep track of the gold market, the trends, and the prices of gold. The gold prices are available online for monitoring. There are gold dealers providing regular updates on the gold prices and in addition these prices are provided in the newspapers and also the television. Buying gold from a reputed gold dealer group is important so that you buy pure gold at the best price. Even a slight fluctuation in the price can bring about a major difference in your investment value and thus, monitoring the gold market is the key to a sound investment decision. The price that you buy the gold bullion and coins would be slightly higher than the rates available on television and the papers. This is due to the fact that there is further effort involved in turning the gold into bars and coins.

Even while you are taking a break the gold market is continuously working and thus, there are bound to be regular changes in the price of gold. It is a solid asset and going by the trends in the gold prices you can be sure of making a huge profit by investing in gold. Advice from an expert in the field would be helpful in deciding the right time to make your investment. With a variety of coins and bars available, you can decide on what you wish to buy in terms of size, weight and the amount of investment. Gold with its strong rise over the years has come to be the ultimate choice for adding a sparkle in your life. Add a new shine to your investment portfolio.…

Strategies For Investment in Mutual Funds – Dollar Cost Averaging & Investment Diversification

Strategies For Investment in Mutual Funds – Dollar Cost Averaging & Investment Diversification

For investment in mutual funds, there are two very effective strategies that you can utilize namely the dollar cost averaging and investment diversification. Mutual funds are probably the best investment vehicle in the financial market available to novice and inexperienced investors. The main reasons for this statement are:-

1. Investors who have just started on their working life can invest with the limited funds available to them.

2. Mutual funds offer a broader choice of funds such as balanced funds, bond funds, growth funds etc. Hence, this option offers diversification in investment for the inexperienced investors.

3. Investors can redeem their investment anytime due to its liquidity.

Many articles have been written on the advantages of dollar cost averaging in particular to investors who do not have the know how and experience in the stock market. Markets may rise and fall as shown in the volatility of the markets in recent months, but generally and historically the market tend to show a long term upward trend. As mutual funds allows investment to be done in a small amount, it is one of the only investment vehicle made available to the ordinary men in the street who can only invest a fixed amount at a regular interval of one month or 3 months depending on his financial resources, by utilizing the dollar cost averaging strategy.

With the variety of choices of funds that most mutual fund companies offers these days, the inexperienced investors do not need to look further into other investments for their asset allocation mix. The investor can shuffle and diversify their assets into the various funds available in accordance to their risk profile and time horizon. Due to the liquidity of mutual fund investment, switching of funds can also be done whenever appropriate based on the prevailing market condition.

Hence, in the investment planning process, the two strategies of utilizing the dollar cost averaging and investment diversification through investment in mutual funds should not be overlooked by the ordinary folks in the street who due to limited funds have no other or very little other options to invest in the financial market.…

The Pros and Cons of Annuities – Is an Annuity the Right Choice For You

The Pros and Cons of Annuities – Is an Annuity the Right Choice For You

Choosing the best annuity that will best meet your retirement investment needs is sometimes a very complicated and complex process because each type of annuity investment has their own way of providing incomes for the investor depending on the needs of the investor. As what all experienced investors would suggest, timing will always be the key to make your annuity investment a lot more productive. If you are in the market looking for the perfect annuity investment that will best fit your requirement you have to understand first the pros and cons of investing in annuities before you make your first step of investment.

Let’s start with the pros. The first main advantage you can get in is financial security and other tax deferment benefits which is always a given factor when it comes to annuity investments. The security you get from depends on the guarantees that come with it. Most of the time, this happens when it comes to fixed annuity rate which allows the investor a guaranteed source of income for the investor’s entire life or up until the agreement expires depending on the agreement between the investor and the insurance company. This allows the investor to enjoy the fruits of his or her investments even if the market performs poorly. But always remember that the percentage of your income from your annuity investment will always depend on the financial strength of the insurance company apart from the market condition during the time of your investment.

Among all the available insurance products you can get, annuities is one of the most secured and it can also guarantee you the safest and most secure source of income even during your retirement. Aside from that, you can also enjoy the benefits of tax deferment during the investing stage and during this deferral phase, the government will not impose any taxes on the annuity investment of the individual.

Like any investments there are also some cons you have to concern yourself with and in the case of annuities, there are some disadvantages you have to consider. The thing about annuity investments are the hidden costs that inevitably come with it. Before you sign for any form of annuity investment, always make sure that all the expenses and costs are clear to your understanding so that you will not be surprised when you have reap your rewards, you will know what to expect. This is also why you have to consider all the total costs and evaluate whether it is the right investment for you. There are also some risks involved when it comes to annuity investment and if you are a policy holder, you must be aware of this. As with all types of investments, there are certain pros and cons of annuities you have to consider and by being aware of these facts will allow you to understand whether your choice is the one meeting your requirements for your own nest egg in the future.…

Moving Companies: An Invaluable Service Provider For Business Owners

Sometimes, due to unforeseen circumstances, a business might move from one location to the other. Whether you are shifting one story up or across the country, moving is stressful, time-consuming, and strenuous.

When moving a business to a new location, an entrepreneur needs to oversee the packaging processes, among a myriad of other critical procedures. Considering this undeniably daunting task, hiring the services of a reputable moving company is the best course of action.

Moving companies are essential service providers

The current CoronaVirus pandemic has wreaked havoc on every sector of the company. With lockdown directives and governments employing the stringiest measures to ensure people stay at home, one of the most frequently asked questions we come across is ‘Are moving companies essential businesses?’

Considering all facts, moving companies are essential businesses. Not only do they help individuals and businesses move, but they are also instrumental in transporting medical supplies and essential workers from one place to the other.

Moving Companies Come With A Myriad Of Benefits For Businessmen

Hiring a moving company is an instrumental part of shifting your business and comes with a lot of benefits.

Let us delve into specifics.

- They are experienced

Moving requires expertise and experience. Unlike you who will throw everything and anything in a packaging box, moving company employees have an articulate methodology on how to go about the whole process. They are well trained in proper packaging processes and will employ safety measures when packing to ensure no breakages occur. Also, since it is in their line of work and have done it severally, they will undertake the packing process fast, efficiently, and effectively.

- They handle tedious heavy-lifting tasks

One of the requirements for moving company employees is having the ability to handle tedious heavy-lifting.

Office furniture can be heavy. Also, considering the number of huge equipment some companies use in facilitating company processes, lifting and carrying them is tiresome. However, moving company employees are used to lifting heavy materials up and down the stairs, among other things. They also know how to efficiently navigate small corners while carrying heavy materials.

So, by hiring a moving company, you eliminate the need for unnecessary heavy lifting. You also save yourself and your employees from unnecessary injuries associated with carrying heavy stuff.

- They eliminate the need for multiple trips

Sometimes, when you have a lot of equipment, moving by yourself might require you to make multiple trips. It is particularly inefficient and expensive when you have to travel long distances.

However, with moving companies, there is no need to make numerous trips to and fro. Moving companies have differently-sized moving trucks that can fit your stuff. If they are still too many, they can arrange for multiple trucks to help you move.

Besides, if you have equipment that requires specialized transportation, it can be easily arranged.

- They offer peace of mind

Most moving companies offer insurance to their clients. That way, you can rest easy knowing that your expensive business equipment is safe. Also, …

Attractive Mutual Funds to Invest in India

Attractive Mutual Funds to Invest in India

Indian mutual fund investment market

The Indian investment market offers many kinds of mutual funds for the beginners as well as for professionals. When you decide to invest for the first time, you definitely have to think about personal budget, investing capacity, ability to take risks and your financial goals. Every investment avenue is linked with different features and investing benefits. Over the past few years the Indian investment market has helped investors fulfill their dreams. The market is expected to do great deal of business in coming years through their newest avenues.

Online investments- a growing practice

With so many investing options available, it becomes very difficult for the beginners to invest in the right avenue. Thanks to availability of online portals, investors are able to study the details of latest products and learn more about their performance. Whether you are a beginner or an expert investor, you have to understand your preferences and budget. Considering budget and time limitations, people find it comfortable to use online portals for their investments. Online investments have helped the investors in many ways. With 24/7 online assistance you can ask the experts about available attractive mutual fund products and their features. Mutual fund investments have now become a preferred choice over other traditional avenues like bank fixed deposits and stocks or bonds.

Different mutual fund options

If you plan to buy mutual funds online, you can easily find out all available products with just a few clicks. Here are some of the very commonly considered investments:

• Bond funds: These funds pay higher interest and are also available in the format of dividends. As the investment value varies, these funds carry a slight degree of risk.

• Balanced funds: Asset allocation funds, lifecycle funds and target retirement funds are three of the most common forms of balanced funds.

• Stock funds: With these funds, investors can gain higher returns by investing more. As these funds are invested in stocks the share value may fluctuate as per the market situations.

• Equity fund: This is one of the most common types of mutual funds that are basically related to stocks. The fund can be easily managed passively or actively.

• Money market funds: Considering their nature and features, the money market funds are one of the safest products currently available in the Indian market. Here, interest is always paid in the format of dividends.

Apart from these investments, you have many other options like systematic investment plan, load funds, no-load funds, tax saving funds, retirement planning funds and Gold ETF funds. Availability of all different investments online has simplified the investing procedure for the beginners as well as for the professional investors. With many new forms of investments, the choice remains yours. Want to invest in the most attractive mutual funds in India? Contact your agent and find out what all opportunities are available in the current market. You will definitely find out a smart investment that perfectly matches your financial goals and your budget. Considering the growing demand from investors, more and more online investment opportunities are being introduced by the Indian investment sector, every year.…

Decision Trees for Sequential Investment Decisions

Decision Trees for Sequential Investment Decisions

In the simple accepted or reject decisions, we can use simple techniques. In practice, the present investment may have implications for future investment decisions. Such complex investment decisions involve a sequence of decisions over time. It is argued that “since present choices modify future alternatives, industrial activity cannot be reduced to a single decision and must be viewed as a sequence of decisions extending from the present time into the future. If this notion of industrial activity as a sequence of decisions is accepted, we must view investment expenditures not as isolated period commitments, but as links in a chain of present and future commitments. An analytical technique to handle the sequential decisions is to employ decision trees. Here we shall illustrate the use of decision trees in analyzing and evaluating the sequential investments.

Steps in decision tree approach

A present decision depends upon future events, and the alternatives of a whole sequence of decisions in future are affected by the present decision as well as future events. Thus, the consequence of each decision is influenced by the outcome of a chance event. At the time of taking decisions, the outcome of the chance event is not known, but a probability distribution can be assigned to it. A decision tree is a graphic display of the relationship between a present decision and future events, future decisions and their consequences. The sequence of events is mapped out over time in a format similar to the branches of a tree.

While constructing and using a decision tree, some important steps should be considered: