US Economy Will Collapse Within 36 Months Say Hedge Fund Manager and How to Protect You From It

“US Economy Will Collapse Within 36 Months” Say Hedge Fund Manager and How to Protect You From It

When I meet a hedge fund manager I always try to ask as many questions about their economy as possible. They have the best research team working for them and you always learn something interesting. What a Hong Kong based manager fund of funds manager, a global macro strategy specialist, with millions dollars asset under management, told me was a bit shocking. He predicted a collapse of the American economy within three years! Here are his arguments and the things he’ll do to protect himself from it.

-The American debt is raising every day

America’s national debt is 14 trillion dollars. If you don’t know what a trillion is that’s 14,000,000,000,000 dollars. And the U.S. national debt will grow to over $20.3 trillion by 2019. The current administration doesn’t want to cut the spending because they are counting on that to be popular. When I was discussing with a Honk Kong based hedge fund manger he even told me that it’s unlikely things would radically change if a new conservative candidate is elected in 2012. He said that G.W. Bush spent a lot while in office and governments just don’t know how to get re-elected without spending a lot to please voters. So it’s likely the US government won’t stop spending until the dollar fails.

-The FED has surpassed China as the leading holder of US treasury securities:

What does it mean? It means that America is basically borrowing from itself and is borrowing a lot. Not a really good idea to borrow from yourself when you’re broke.

-Fannie Mae and Freddie Mac still exist

Fannie Mae and Freddie Mac, both government-sponsored enterprises, were major causes in the subprime crisis. Following Washington orders, they spent billions to loan to low-income families. As we all know the results were disastrous. However, believe it or not, politicians did nothing to eliminate them. With Fannie Mae and Freddie Mac still operating another major crisis will occur said the manager.

How to protect yourself from a collapse?

Own other currencies:

The Swedish Krona, the Swiss franc and the Hong Kong dollar are among the best currency to own right now. That’s because these countries are controlling their spending and have a solid economy.

Own Hong Kong or Singapour based companies stock:

Hong Kong and Singapour are two of the wealthiest and economically healthiest places in the world. Invest here is pretty safe and allows you to have a diversified portfolio.

Own gold:

Gold is what you want to have when a crisis occur. Owning gold protects you from a fall of the dollar value because it’s a universal form of payment.

Is there any hope? The manager I met told me that only one candidate could stop the crazy spending: Ron Paul. Results of the recent straw polls are encouraging. Let’s hope American voters will make the right choice in 2012.…

Active Or Passive Investment Management: The Pros And Cons

Active Or Passive Investment Management: The Pros And Cons

An ongoing argument in many investment circles is whether to take an active approach where you pick and choose which securities to buy and sell based on a fundamental, technical and other types of research, or whether you should take a passive approach where you stick with an Index and follow that passively, most often through an exchange traded fund (ETF) or an Indexed Mutual Fund.

There are some very compelling arguments for each management type, which we look at here. The bottom line, however, is that both require active monitoring but often for different reasons.

Active Management

In an actively managed investment portfolio, the investor will pick and choose which funds in which to invest. These portfolios clearly involve a lot more work for the investor given the amount of market and specific security research that will go into deciding which securities to hold, but the test of success will often get measured against an index, such as the S&P 500. For this reason, active portfolio managers will often be sure to incorporate many of the index’s bigger names in order to provide several key, core holdings.

The management of actively managed portfolios is intensive as well and it requires considerable discipline. Since the success of any portfolio is often attributed to one’s asset mix, making sure higher growth assets are trimmed at times when it might “feel” better to let them ride is not an easy decision. And knowing what to do with the excess capital once those positions have been trimmed is not so easy, either. With active management, you are a lot more active.

Passive Management

Although passive management implies that an investor puts money into and index fund and leaves the portfolio alone for thirty years or however long one decides, this is not the case. For passive investors, there will always the matter of rebalancing their overall portfolio so that they are not overexposed to one asset class or another. However, the bigger risk is investing in the wrong index. So while passive investment management means eliminating the need to pick individual securities, it does not let the investor completely off the hook. Given the sheer number of equity indexes out there, figuring out which one works best and at which time (remember, they are still equities) is the tough decision.

In other words, the analysis and decision making remains, even with index investors, but the scope and type of analysis is quite different. In some ways, it could be easier, but the investor will likely take a more macro view of which segment or index is likely to perform well.

For investors that really want to be passive, sticking with a broad index, like the S&P 500 index, can certainly make sense. However, with the returns such a broad index has returned compared to others, it may make more sense to get into an actively managed mutual fund instead, where security selection is looked after and where many have returned much better than the index.

Summary

Deciding whether to be an active or passive investor is not an easy decision. Both require a fair degree of discipline and at least some time to monitor the progress and performance of the portfolio. Working with a professional planner is often the best solution in both instances.A�…

Here Are My Top 5 Stock Market Investment Tips

Here Are My Top 5 Stock Market Investment Tips

If you’re looking for stock market investment tips keep reading because today I am going to give you my top 5 tips. Here are my top 5 stock market investment tips.

A� The market pays you to be disciplined – Trading with discipline is an absolute must, it will allow you to put more money into your pocket than you take you. At the end of the day the one constant truth concerning the markets is discipline = money.

A� Always lower your trade size when you’re trading poorly – All good traders follow this rule. If you have two losing trades in a row lower your trade size down to a one lot. If your next two trades are profitable, then move your trade size back up to what it was originally.

A� Never turn a winner into a loser – I am sure that you have made this mistake before. What we are really talking about here is greed. The market rewards you by moving in the direction of your position, you hold on in hopes of making a larger gain only to watch the market turn against you. Of you course you now hesitate and the trade further deteriorates into a substantial loss. There is no need to be greedy, it is only one trade, you’ll make many more so relax. One trade should not make or break your performance for the day. So don’t be greedy.

A� Your biggest loser can’t exceed your biggest winner – Keep a log of all your trades for the session. Take note of your biggest winner and do not allow a losing trade to exceed it. If you do allow a loss to exceed your biggest gain then effectively what you have is a net loss of the two trades. Not a good idea.

A� Develop a methodology and stick with it, don’t change methodologies from day to day – Write down the specific market prerequisites that must take place in order for you to make a trade. It doesn’t necessarily matter what the methodology is but it is important that you have a set of rules, market setups or price action that must appear in order for you to make the trade. You must have a game plan. If you have a proven methodology but it doesn’t seem to be working in a trading session don’t go home that night and try to devise another one. If your methodology works more than one-half of the time stick with it.

These are the best stock market investment tips I can give you, if you need more money…

Axis Mutual Fund Income Saver Fund

Axis Mutual Fund Income Saver Fund

Mutual fund is one of the best way to save money. Different companies provide different schemes to save money in various ways. Axis Mutual Fund is a great organization and currently offers income saving fund.

Objective of the fund:

The main objective of the fund is to be an income fund which would provide regular income for a short period of time. The time duration would depend on the period the customer chooses to invest in. The Major portion of the money that is collected from the investors is invested in the money market securities as well as in the debt market. Consequently, a kind of regular income is generated from the fund not only in the form of dividend payments but also in the form of coupon payments.

In this kind of fund, a small portion of money is invested in the equity market as well, so as to get some derivative products. This in turn can help to generate capital appreciation in some form or the other. This is again done in order to get a regular income for the regular investors or the payouts by means of majority of the investment in the bonds, debt as well as the money market.

Minimum Investment:

The minimum amount that can be invested in the scheme for the regular income is about Rs 5000. Consequently, it can be invested in the multiples of Re 1. There is absolutely no entry load. On the other hand, there is an exit load of about 1% if the scheme is redeemed within 1 year right from the date of allotment.

How to invest?

If you are interested in investing such a scheme, then you can view the details in various websites. You can find the instructions regarding the mode of investment in the income saver fund. These websites also helps you to invest in the schemes online.…

Importance of Asset Mix in Financial Planning

Importance of Asset Mix in Financial Planning

The most important starting point when building a portfolio is asset mix. In fact, it is so important that if it is done incorrectly, the investor stands to not only lose over the course of his or her investment career, but will be subjected to tremendous and unnecessary strain and stress. The right asset mix will help reduce losses to acceptable psychological and, hopefully financial, limits by incorporating the following:

1. Time Availability. By incorporating an investor’s time availability, the asset mix can provide investors with an acceptable level of risk. Most evidently, short-term availability will limit the investor’s investment choice to more conservative investments so that there is little, if any, risk of loss on the principal amount being invested.

2. Investment Goals. By incorporating an investor’s investment goals into the asset mix, financial planners and even individual investors are able to see where they intend to invest. An investor is more growth-oriented will understand that their portfolio will fluctuate, sometimes greatly and will therefore be better prepared mentally to accommodate such fluctuations compared to a more income-oriented investor who would not. Knowing what your goals are is important, so make sure you give the question the attention it deserves.

3. Risk Tolerance. While time and investment goals are very important, someone with sufficient time to invest and a growth mentality will need to have the risk tolerance to support the growth investments. If risk tolerance is low in spite of the investor’s investment goals, then growth assets are normally not recommended on any large scale. Instead, growth would be limited to the point where even the most dramatic fluctuations to that part of the investor’s portfolio would have little or no consequence to the overall financial objective.

An appropriate asset mix will incorporate each of the above factors. Conveniently, these are also the most basic questions one must ask himself or herself when constructing an investment plan; by asking these questions and knowing the answers, an appropriate asset mix can be constructed and the plan can be implemented.

In the event of shortfalls or major discrepancies (such as an investor who wants to save $1,000,000 over a 15 year period but has so little risk tolerance than a maximum annual return of 5% is more realistic than the higher rates earned on growth investments), then changes need to be made to the asset mix. That means the investors will need to re-examine how the three factors above were measured; can they take a little longer to save, can their goals shift to more aggressive, growth-oriented goals and/or can they accept a higher degree of risk. If the answer is no, then they will need to adjust their overall goal.…

Investing Online: High-Payout Investment

Investing Online: High-Payout Investment

For all of you active investors out there, most likely you are seeking high-payout investments. If you don’t have much patience or are ravenous, you want money soon, regardless of the risk you must take. Before you chase after a high-payout investment you should be aware of what you’re getting into.

Savvy investors by all means inquire about the payout ratio of a particular investment before jumping on it. Payout ratio is defined as the funds a company disburses to shareholders in comparison to how much it retains for itself. This can be done in a matter of seconds and will save you a great deal of money in the long run. Knowing this ratio can help you determine how much you will receive in the future.

Understanding Payout Ratio

What exactly is this ratio and how does it work? Once you purchase at least one company share, you own a part of that entity.

Payout Ratio = Dividends per Share / Earnings per Share

So if the payout ratio is 1:10, it can be expressed as.10 or 10%. That means your dividend is 10% of their earnings.

The remainder of the funds, 90% is then invested back into the business to help it grow. Hence, for a high payout, the closer the two numbers are to equaling one-another, the higher the ratio ($7:$8 means an 87.5% payout ratio). A higher ratio is not always better.

Investing In High Ratio Companies

Some companies have a payout ratio of over 100%. How can that be? Either that entity has a high debt ratio or used the funds in its savings to pay dividends.

Is investing in a company with too high of debt ratio dangerous? Not necessarily. There are many entities that have a bad year causing a surge in their debt ratio. However, as an investor you need to reduce as much risk in your portfolio as possible. You can never rely on a company reducing its debt ratio or expect to receive payments if their ratio is high. Therefore, you will want to focus on companies with a 75% ratio or lower.

Company size is another factor to consider. This means researching company profiles to determine their annual sales revenues, their financial sources, the type of ownership (partnership, corporation, etc), management structure(vertical communication, authority-based influence, etc), and their market shares. Knowing their history and stability are essential before investing. If there are no profiles available, consider another entity.

The Higher the Payout, the Greater the Risk

The higher the payout an investment has, the greater the risk it carries. Investing in high-risk companies isn’t worth taking the chance, especially if you’re a novice. Such investments may be worth trying, that’s of course if you have extra money to burn.

However, investments offering high-payout dividends can provide you with a lifelong income. Receiving dividends regularly will help you in financial planning and possibly future investments.

Doing research may seem arduous, but skipping this task will most likely cost you a great deal of money later.…

Real Estate Investing FAQ

Real Estate Investing FAQ

Real estate investing can be one of the most rewarding endeavors that you ever take on. At the same time, it can be very confusing. Because of that, there are a number of frequently asked questions that most people have about investing in property. Here are a few of those questions that you might be asking also.

When Is the Right Time to Start?

When it comes to real estate investing, the sooner the better. You need to get started investing as soon as you possibly can. While each situation is going to be different depending on personal factors, you should strive to get started in the market as soon as you can. This will allow you to start building equity in the properties and you will be able to start benefiting from your investments sooner. One of the best things about investing in properties is that the assets will appreciate over time. By getting your property purchased sooner, you will be able to start taking advantage of this appreciation.

Is Investing in Real Estate Safe?

Many people are scared of investing after a lot of the negative press that they have heard about the real estate market. However, this kind of investing is one of the safest investments that you could make. This should be looked at as a long-term investment and not something that you get into and out of quickly. It is one of the few things that is going to always have some type of value. As long as you have insurance on your property, the property that you buy is going to be worth something. While the market does go through down cycles, it has always rebounded well in the past.

How Much Money Should I Invest?

This is another question that you are going to have to answer on a personal basis. However, real estate is one of the few things that you can invest in with the help of other people’s money. You want to typically put some type of your own money into the investment so that you will be able to generate a positive cash flow. However, you can purchase the majority of the property with a loan from the bank. This decreases the amount of money that you have to put into the investment and helps to lower your risk overall.

What Type of Property Should I Invest in?

There are a number of different types of real estate that you could potentially invest in. Everyone has their own tastes and risk tolerance. If you want something that is going to bring in a long-term source of income, you might want to get involved in commercial real estate. The only problem with this is that it takes a much larger initial investment. If you are wanting to get started on a smaller scale, you might by a single residential rental property. This will allow you to start getting some cash flow and building some equity in a property.…

What Are The Benefits Of Having An Accountant?

Accounting tasks include both simple responsibilities, bookkeeping, recording receipts, tax returns, and setting financial targets. These sorts of tasks are imperative to business success and stability, but they also absorb tons of your time.

Most small business owners don’t have an expansive knowledge of accounting procedures and practices, yet they’re still required to manage such tasks. Most of the owners of small businesses consider bookkeeping and accounting as the most tedious work for them. Accounting mistakes are bad, they will cost you thousands in revenue and might even be the end of your business.

There are accounting firms new jersey for little businesses able to assist you in solving these complex accounting problems and ensure no mistakes are made.

An accountant’s job is to keep themselves clued abreast of the financial well-being of a business. As such, they’re more likely to note when money is being spent unnecessarily. While you’re trying to find opportunities to expand your brand you may be missing some costly financial drains. Hiring an accountant for your small business allows you to delegate these time-consuming tasks and specialize in what’s really important – growing your business and having a decent work life balance.

Many businesses, including startups, also as established businesses, prefer hiring services of good accounting firms in New Jersey thanks to various reasons. Most of the start ups fail within the very first year due to lack of understanding the ways to manage their accounts. Most of them don’t hire an expert accounting company because of the extra burden of their fee but they do not understand their importance in handling taxation problems also as finding out growth opportunities for his or her business. Some of the explanations that businesses should hire good accounting firms new jersey are provided hereunder to assist in making a right decision.

Often business owners aren’t ready to see the whole image of their business thanks to their involvement in its daily operations. An individual who isn’t connected with the business can only provide a unique viewpoint for the expansion of the company which may be missed otherwise. Though hiring accounting firms in New Jersey seems to be retracting back but the freshness it’ll provide to the image of your business can balance all things. A big idea suggested by the accounting firm can take all the setbacks effectively.

Most of the outsourcing accounting firms in New Jersey work with a number of different kinds of industries and businesses which provides them vast knowledge and insight into the business world. So you can’t undervalue the suggestions provided by them for the betterment of your business. Alongside having information about the financial matters of several businesses they also realize the mistakes committed by the failing businesses as well as the best practices employed by the companies to make their business successful. All these insights and knowledge shared by the hired accounting firms new jersey can help in reinventing the ways to grow your business sooner.…

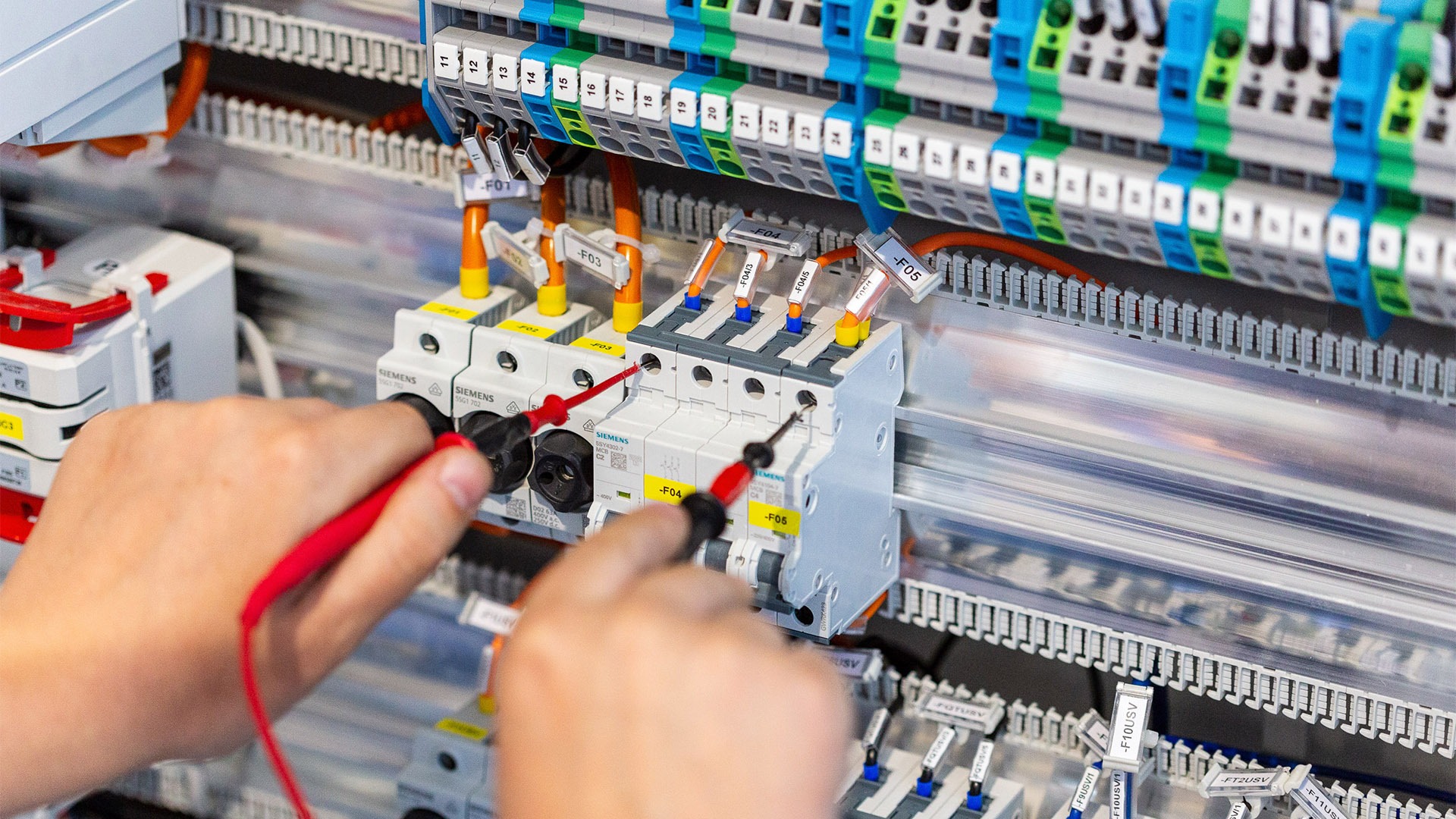

5 Important Tips To Keep Your Electrical Installation Safe For Your Family

There’s few things in the world as amazing as having one’s own family. There’s really only one downside to the experience. And that’s the concern and fear one often has for their safety. Every new parent can attest to the fact that they see just how dangerous the world can be. But there are ways to make every home fully safe for one’s family. And it’s best to begin by looking at five simple tips to ensure a home’s electrical system is safe. After securing your electric system then it’s good to invest in Reliant Energy Houston since they offer renewable energy that will help you protect the environment and save a lot on your power bill.

1. Watch out for flickering lights

Flickering lights are often used in movies to announce that there’s spirits in the property. In reality flickering lights pose a more realistic concern. People should make note of lights which seem to flicker on a regular basis. This can consist of a few different issues. The most common and easily fixed are problems with one’s light bulbs. One should begin troubleshooting by simply changing out the bulbs. If flickering persists then it might be the light fixture or lamp which is the issue. If this isn’t the case then it may well signal an underlying issue with the home’s internal electrical system. In this case it’s time to call an expert to fix the issue.

2. Extension cords should be used with caution

It seems like there’s seldom enough power to go around at times. Everyone has more and more portable devices these days. And it can lead one to want to charge them up anywhere and everywhere. This often leads to using extension cords to bring electricity to areas which wouldn’t ordinarily have it.

However, extension cords can be as dangerous as they are useful. It’s important to keep in mind that an extension cord is basically just adding wiring to an area. And there’s a good reason why one doesn’t simply open up an outlet to try bringing all of the wires out for easier access. Overuse of extension cords is essentially like trying to add wiring on one’s own. One extension cord is usually fine. But instead of using more one should consider calling an electrician in to add extra outlets.

3. Watch out for rust or mold

Rust or mold can arise due to any number of different problems. But it all comes down to one underlying issue. Where there’s rust or mold there’s water. And water and electricity simply aren’t a good match for each other. As such, one should keep an eye out for rust or mold around electrical sockets. This doesn’t always mean that the water extends past the outlet itself. But it’s enough of a concern that one should always call in an expert to check it out.

4. Lights or appliances which won’t turn on

It’s easy to overlook an outlet which simply doesn’t seem to be working. Everyone knows the sign of an outlet with issues. One plugs a device in and it simply won’t turn on. It’s easy to ignore the problem and simply use a different outlet. However, it’s better to call someone in to look at it. This is because a problem with one outlet often suggests larger issues with the wiring as a whole.

5. Remember to use local help

It’s usually best to use local help for one’s electrical needs. For example, someone in Daytona Beach would look for an electrician Daytona Beach adjacent. There’s a few reasons why someone in this situation would look for an electrician Daytona Beach adjacent. But one of the biggest reasons comes down to response time.

One should ideally have everything safeguarded to a point where emergency electrical work won’t be needed. But if it is needed then a local electrician should be able to provide a more rapid response than a non-local electrician.

…