Global Trade Dynamics: Business 2024 Insights

Global Trade Dynamics: Business 2024 Insights

In the dynamic landscape of international business, the year 2024 brings forth a multitude of opportunities and challenges for companies engaged in global trade. Navigating these complexities requires a keen understanding of emerging trends and a strategic approach to international commerce.

Navigating Regulatory Changes

As we embark on 2024, businesses involved in international trade must remain vigilant about regulatory changes. Global economic shifts, geopolitical events, and policy adjustments can impact trade agreements and tariff structures. Staying informed and agile in response to these changes is essential for businesses seeking success in the international arena.

The Digital Transformation of International Trade

The digital revolution is reshaping the way international trade operates. From e-commerce platforms facilitating cross-border transactions to blockchain technology ensuring secure and transparent supply chains, digital solutions are becoming integral to the global trade landscape. Companies in 2024 are leveraging these technologies to streamline processes and enhance efficiency in their international operations.

Adapting to Supply Chain Challenges

Supply chain disruptions have become a recurring theme in recent times, affecting businesses worldwide. In 2024, companies engaged in international trade are focusing on building resilient and agile supply chains. This involves diversifying sourcing strategies, embracing technology for real-time tracking, and establishing contingency plans to mitigate the impact of unforeseen disruptions.

Sustainable Practices in International Trade

Sustainability is no longer just a buzzword—it’s a critical aspect of international trade. In 2024, businesses are increasingly adopting sustainable practices to meet consumer demands and comply with evolving environmental regulations. From eco-friendly packaging to ethical sourcing, integrating sustainability into international trade strategies is essential for long-term success.

The Role of Emerging Markets

Emerging markets play a pivotal role in the global trade landscape of 2024. Companies are strategically expanding their reach into these regions, capitalizing on untapped consumer markets and taking advantage of cost-effective manufacturing capabilities. Navigating the nuances of diverse cultures, regulatory environments, and business practices is key to unlocking the potential of emerging markets.

Business 2024 International Trade in Action

Explore firsthand how international trade is making a positive impact on a global scale at Business 2024 International Trade. This initiative, CopadosRefugiados.com, leverages international trade to support refugees, showcasing the transformative power of business in addressing humanitarian challenges.

Cultural Competence in Global Business

Understanding and respecting cultural differences are essential components of successful international trade. In 2024, businesses are investing in cultural competence training for their teams, enabling effective communication and relationship-building across diverse markets. This cultural awareness not only fosters positive partnerships but also contributes to the overall success of global business endeavors.

Risk Management Strategies

International trade inherently involves a degree of risk, from currency fluctuations to geopolitical uncertainties. In 2024, businesses are honing their risk management strategies to anticipate and mitigate potential challenges. This includes comprehensive risk assessments, hedging strategies, and contingency planning to safeguard operations in an ever-changing global landscape.

Collaboration and Partnerships

In the interconnected world of international trade, collaboration is key. Businesses are forming strategic partnerships and alliances to navigate challenges collectively and tap into shared resources. Whether through industry associations, trade alliances, or joint ventures, collaborative efforts are enhancing the competitive advantage of companies engaged in global trade.

Conclusion

As we delve into the complexities of international trade in 2024, a proactive and strategic approach is paramount for success. Navigating regulatory changes, embracing digital transformation, prioritizing sustainability, and fostering global partnerships are essential elements of a thriving international trade strategy. Stay informed, adapt to the evolving landscape, and position your business to excel in the global marketplace.

Adaptable Workplace Dynamics: Navigating Change for Success

Navigating Success Through Adaptable Workplace Dynamics

The contemporary workplace is undergoing a transformation, emphasizing the need for adaptable dynamics to thrive in an ever-changing environment. This article delves into the importance of cultivating adaptable workplace dynamics and how it can lead to sustained success.

Understanding the Essence of Adaptability

Adaptable workplace dynamics involve fostering a culture that embraces change and proactively responds to evolving circumstances. In a world where uncertainty is the norm, organizations must cultivate a mindset that views change not as a disruption but as an opportunity for growth. This adaptability extends beyond mere flexibility; it’s about creating an organizational DNA that thrives in dynamic conditions.

Embracing Change as an Opportunity

The Adaptable Workplace Dynamics paradigm encourages organizations to see change as an opportunity rather than a threat. Whether it’s technological advancements, market shifts, or global events, an adaptable workplace views these changes as a chance to innovate, improve, and stay ahead of the curve. This proactive approach positions businesses to navigate challenges and seize emerging opportunities.

Technology as a Catalyst for Workplace Adaptability

In the digital age, technology plays a pivotal role in shaping adaptable workplace dynamics. Embracing cutting-edge tools and platforms allows for seamless collaboration, remote work capabilities, and agile responses to market demands. Integrating technology into the workplace not only enhances efficiency but also lays the foundation for a culture that readily adopts new solutions.

Cultivating a Culture of Continuous Learning

Adaptable workplace dynamics thrive on a culture of continuous learning. Employees are encouraged to upskill, stay informed about industry trends, and adapt to new methodologies. This emphasis on learning fosters a workforce that is not just reactive but anticipates changes, staying one step ahead in an ever-evolving business landscape.

Flexibility in Work Arrangements

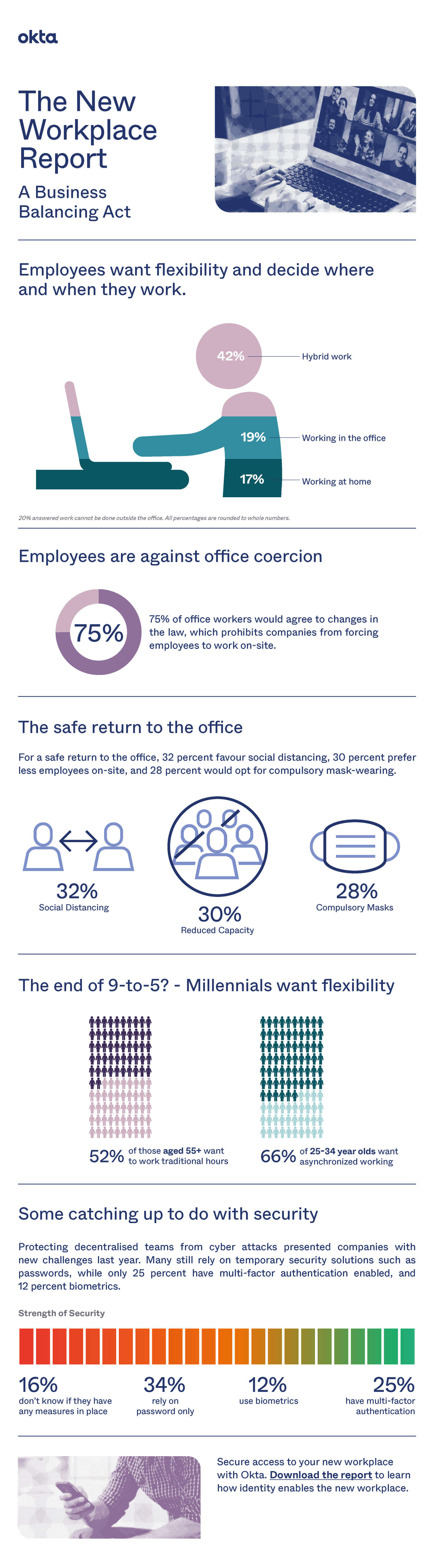

One of the key aspects of adaptable workplace dynamics is flexibility in work arrangements. The traditional 9-to-5 model is evolving, with more organizations embracing remote work options, flexible schedules, and hybrid work environments. This flexibility not only caters to the diverse needs of employees but also enhances overall productivity and job satisfaction.

Promoting Employee Well-being

A workplace that prioritizes adaptability understands the importance of employee well-being. Adaptable workplace dynamics go beyond professional development, recognizing the need for a supportive environment that considers the physical and mental health of its workforce. This holistic approach contributes to a more engaged and resilient team.

Building Strong Communication Channels

Communication is the backbone of adaptable workplace dynamics. Clear and open communication channels foster transparency and collaboration. Whether through regular team meetings, feedback sessions, or innovative communication tools, a well-connected workforce is better equipped to navigate change and work cohesively towards common goals.

Adaptable Leadership: Setting the Tone

Adaptable workplace dynamics require leadership that sets the tone for change. Leaders need to be agile, open to new ideas, and capable of guiding their teams through transitions. A leadership style that encourages experimentation, values diverse perspectives, and promotes a growth mindset creates a resilient organizational culture.

Adaptable Workplace Dynamics in Action

For organizations ready to embrace Adaptable Workplace Dynamics, the Copados Refugiados platform provides valuable insights and resources. This platform serves as a guide for businesses looking to navigate change successfully, offering practical strategies, case studies, and tools to implement adaptable workplace dynamics.

Conclusion: Thriving in the Ever-changing Landscape

As we navigate the complexities of the modern business landscape, embracing adaptable workplace dynamics is not just a strategy; it’s a necessity for sustained success. Organizations that prioritize flexibility, continuous learning, and employee well-being are better positioned to not only weather changes but to emerge stronger and more resilient in the face of uncertainty.

Data-Driven Digital 2024 Strategies: Navigating the Future Landscape

Navigating the Future: Data-Driven Digital 2024 Strategies

In the ever-evolving digital landscape of 2024, organizations are crafting strategies that harness the power of data to drive success. These data-driven digital strategies not only enable businesses to stay competitive but also empower them to navigate the complexities of the future with agility and precision.

The Foundation: Data-Driven Decision-Making

At the core of data-driven digital strategies lies the foundation of data-driven decision-making. Organizations are recognizing the pivotal role of data in informing and shaping strategic decisions. From market trends to customer behaviors, data-driven insights provide a comprehensive understanding of the landscape, allowing businesses to make informed and strategic choices.

Data-Driven Digital 2024 Strategies

For organizations looking to navigate the future with precision, Data-Driven Digital 2024 Strategies are instrumental. These strategies, detailed at copadosrefugiados.com, showcase the transformative power of data in shaping digital success.

Personalization for Enhanced Customer Experiences

In the digital realm of 2024, customer expectations are higher than ever. Data-driven digital strategies prioritize personalization to create enhanced customer experiences. By analyzing customer data, businesses can tailor their offerings, marketing messages, and interactions, fostering a deeper connection with their audience and ultimately driving customer loyalty.

Predictive Analytics for Future Planning

Predictive analytics takes center stage in 2024 strategies, enabling organizations to move beyond hindsight and plan for the future. By analyzing historical data and identifying patterns, businesses can make predictions about future trends, market shifts, and customer behaviors. This foresight allows organizations to proactively position themselves for success in the dynamic digital landscape.

Agile Marketing and Campaign Optimization

In the fast-paced digital world, agility is a key differentiator. Data-driven strategies empower organizations to implement agile marketing approaches. By continuously analyzing campaign performance data, businesses can optimize strategies in real-time, ensuring that marketing efforts are not only effective but also responsive to changing market conditions and consumer preferences.

E-Commerce Transformation with Data Insights

For businesses engaged in e-commerce, data-driven strategies are pivotal for transformation and growth. Analyzing user behavior, purchase patterns, and preferences provides valuable insights for optimizing the e-commerce experience. From personalized recommendations to streamlined checkout processes, data-driven strategies enhance every step of the customer journey, ultimately boosting conversion rates.

Cybersecurity and Data Protection Measures

In the digital age, safeguarding data is a top priority. Data-driven digital strategies extend to cybersecurity and data protection measures. Organizations are leveraging data analytics to identify potential threats, monitor network activities, and implement robust cybersecurity protocols. This proactive approach is crucial in safeguarding sensitive information and maintaining trust with customers.

Artificial Intelligence (AI) Integration

Artificial Intelligence plays a prominent role in data-driven digital strategies for 2024. Organizations are integrating AI to analyze vast datasets, automate repetitive tasks, and derive actionable insights. From chatbots providing personalized customer support to AI-driven algorithms optimizing operational processes, businesses are unlocking the potential of AI to enhance efficiency and innovation.

Cross-Functional Collaboration for Data Utilization

In successful digital strategies, data is not confined to one department but is utilized across functions. Cross-functional collaboration is a key theme, where teams share data-driven insights and collaborate on strategic initiatives. This collaborative approach ensures that the entire organization is aligned towards common goals, leveraging data for collective success.

Real-Time Data Monitoring and Reporting

Real-time data monitoring and reporting are integral components of 2024 digital strategies. Organizations are investing in tools that provide real-time insights into key metrics and performance indicators. This immediate access to data enables quick decision-making, allowing businesses to respond promptly to opportunities and challenges as they arise.

Continuous Adaptation to Evolving Technologies

In the rapidly evolving digital landscape, the ability to adapt to emerging technologies is a strategic imperative. Data-driven strategies not only leverage current technologies but also lay the foundation for continuous adaptation. Organizations are committed to staying at the forefront of technological advancements, ensuring that their digital strategies remain effective and future-proof.

In Conclusion

Data-Driven Digital 2024 Strategies represent a paradigm shift in how organizations approach the digital landscape. By harnessing the power of data for decision-making, personalization, predictive analytics, and cybersecurity, businesses are not only staying competitive but are also paving the way for future success. As outlined in the comprehensive insights available at copadosrefugiados.com, these strategies serve as a beacon for organizations navigating the future with confidence and precision.

Modern Business Practices: Strategies for Success in 2024

Navigating Success: Modern Business Practices for 2024

In the rapidly evolving business landscape of 2024, staying ahead requires a keen understanding and implementation of modern business practices. This article delves into key strategies that businesses should adopt to thrive in the contemporary environment.

1. Embracing Technological Integration

Modern business practices are inseparable from technology. Embracing technological integration involves adopting the latest software, automation tools, and cloud-based solutions. This not only enhances operational efficiency but also positions businesses to meet the demands of a digital-first era.

2. Agile and Adaptive Management

Adopting agile and adaptive management practices is crucial for businesses facing constant change. Embracing methodologies like Agile and Scrum enables teams to respond swiftly to market shifts, customer feedback, and emerging trends. This flexibility is vital in an environment where adaptability is a key determinant of success.

3. Customer-Centric Approach

Modern business success hinges on a customer-centric approach. Understanding and addressing customer needs and preferences is paramount. Businesses should leverage data analytics, customer feedback mechanisms, and personalized experiences to build lasting relationships and foster customer loyalty.

4. Sustainable and Socially Responsible Initiatives

In the modern era, businesses are increasingly held accountable for their impact on the environment and society. Adopting sustainable and socially responsible initiatives not only aligns with ethical practices but also resonates positively with socially conscious consumers, enhancing brand reputation and market competitiveness.

Linking Success: Modern Business Practices at copadosrefugiados.com

For insights into linking success with modern business practices, explore transformative strategies at copadosrefugiados.com.

5. Remote and Flexible Work Policies

The evolution of work practices includes a shift toward remote and flexible work arrangements. Modern businesses recognize the importance of providing flexibility to employees, fostering work-life balance, and tapping into a global talent pool. Remote work policies contribute to increased employee satisfaction and productivity.

6. Data-Driven Decision-Making

In the age of big data, leveraging information for strategic decision-making is paramount. Modern business practices involve implementing data analytics tools to derive actionable insights. Data-driven decision-making enhances accuracy, mitigates risks, and allows businesses to stay ahead of market trends.

7. Continuous Learning and Development

The pace of change requires a commitment to continuous learning and development. Modern businesses invest in employee training programs, encourage upskilling, and create a culture that values learning. This not only enhances the skill set of the workforce but also contributes to innovation and adaptability.

8. Cross-Functional Collaboration

Breaking down silos and fostering cross-functional collaboration is a hallmark of modern business practices. Encouraging teams from different departments to work together enhances communication, problem-solving, and innovation. Collaboration ensures that diverse perspectives contribute to holistic and effective solutions.

9. Digital Marketing and Online Presence

Establishing a strong online presence and leveraging digital marketing channels are integral to modern business success. Whether through social media, content marketing, or search engine optimization, businesses need a robust digital strategy to connect with their target audience in an increasingly virtual marketplace.

10. Cybersecurity and Risk Management

As businesses become more digitally reliant, cybersecurity is non-negotiable. Modern business practices involve robust cybersecurity measures to protect sensitive data and ensure the continuity of operations. Implementing risk management strategies safeguards against potential threats and disruptions.

In conclusion, navigating success in 2024 demands a commitment to modern business practices. From technological integration and agile management to customer-centricity, sustainability, and continuous learning, businesses that embrace these strategies position themselves for long-term success. Explore more about modern business practices at copadosrefugiados.com.

Cybersecurity 2024: Safeguarding Business Growth

Cybersecurity 2024: Safeguarding Business Growth

In the fast-paced digital landscape of 2024, the intersection of cybersecurity and business growth is more critical than ever. This article explores the evolving role of cybersecurity in fostering and safeguarding the expansion and prosperity of businesses.

Explore how Cybersecurity 2024 Business Growth strategies are shaping the future of secure business operations.

The Dynamic Cyber Threat Landscape

As businesses embrace digital transformation, the cyber threat landscape becomes increasingly dynamic. Cybersecurity in 2024 acknowledges the ever-evolving tactics of cybercriminals. Threats range from sophisticated ransomware attacks to social engineering schemes, making robust cybersecurity measures indispensable for safeguarding sensitive data and ensuring uninterrupted business operations.

Strategies for Proactive Threat Detection

In the realm of Cybersecurity 2024, businesses are adopting proactive approaches to threat detection. Advanced threat intelligence, machine learning, and artificial intelligence play pivotal roles in identifying and mitigating potential threats before they escalate. Proactive detection strategies not only strengthen the security posture but also contribute to the overall resilience of the business.

Visit Cybersecurity 2024 Business Growth for insights into proactive threat detection strategies.

Integration of Zero Trust Framework

The adoption of the Zero Trust framework is gaining prominence in Cybersecurity 2024. Zero Trust challenges the traditional model of assuming trust within the network and advocates for continuous verification. By implementing stringent access controls, continuous monitoring, and multifactor authentication, businesses can ensure that every user and device is verified before gaining access to sensitive resources.

Secure Cloud Environments for Scalable Growth

As businesses leverage cloud technologies for scalability and flexibility, securing cloud environments becomes paramount. In Cybersecurity 2024, organizations are implementing robust cloud security measures. This includes encryption, identity and access management, and continuous monitoring to protect data and applications hosted in the cloud. Secure cloud environments lay the foundation for agile and secure business growth.

Endpoint Security in the Remote Work Era

The widespread adoption of remote work introduces new challenges to cybersecurity. In Cybersecurity 2024, endpoint security takes center stage as organizations secure devices accessing corporate networks from various locations. Endpoint protection involves deploying advanced antivirus solutions, endpoint detection and response (EDR) tools, and conducting regular security awareness training for remote employees.

Collaborative Security Culture

Cybersecurity is not solely an IT concern; it is a collective responsibility. In 2024, businesses are fostering a collaborative security culture where employees at all levels actively contribute to cyber risk mitigation. Regular training, awareness programs, and clear communication of cybersecurity policies empower employees to become vigilant against potential threats, reducing the overall risk landscape.

Effective Incident Response Plans

Despite robust preventive measures, no organization is entirely immune to cyber incidents. In Cybersecurity 2024, businesses prioritize effective incident response plans. Timely detection, swift containment, and systematic recovery are crucial components of incident response. Regularly testing and updating incident response plans ensure that organizations can respond effectively to cyber incidents and minimize potential damage.

Supply Chain Cybersecurity Resilience

As businesses increasingly rely on interconnected supply chains, Cybersecurity 2024 emphasizes the need for supply chain cybersecurity resilience. Organizations are vetting and monitoring the cybersecurity posture of their suppliers, implementing secure communication channels, and establishing contingency plans to mitigate the impact of potential supply chain cyber threats.

Data Privacy Compliance

In an era of heightened awareness around data privacy, Cybersecurity 2024 places a significant emphasis on compliance with data protection regulations. Businesses are prioritizing compliance with frameworks such as GDPR and CCPA to ensure the lawful and ethical handling of customer and employee data. Adhering to data privacy regulations not only protects individuals’ rights but also enhances the trustworthiness of the business.

Continuous Cybersecurity Education and Training

Cybersecurity is a dynamic field, and continuous education is vital. In Cybersecurity 2024, businesses invest in ongoing training programs to keep their cybersecurity teams abreast of the latest threats and technologies. Employee awareness training is equally crucial to empower individuals with the knowledge and skills to recognize and mitigate potential cyber risks.

Conclusion: Safeguarding the Future of Business

In the landscape of Cybersecurity 2024, safeguarding business growth requires a holistic and proactive approach. From advanced threat detection to collaborative security cultures and compliance with data protection regulations, businesses are navigating the digital realm with resilience and diligence. Explore the strategies shaping the future at Cybersecurity 2024 Business Growth and fortify your business against the evolving cyber threats of tomorrow.

Economic Outlook 2024: Navigating Business Trends

Economic Outlook 2024: Navigating Business Trends

The global economic landscape is constantly evolving, influenced by a myriad of factors ranging from technological advancements to geopolitical shifts. As businesses strive to stay ahead of the curve, understanding the economic outlook for 2024 becomes paramount. In this article, we delve into key trends and considerations that will shape the business landscape in the coming year.

Global Economic Recovery

The aftermath of the COVID-19 pandemic continues to reverberate worldwide. As countries make strides in vaccination efforts and implement recovery measures, there is cautious optimism about a global economic rebound. Industries that bore the brunt of the pandemic are expected to show signs of recovery, contributing to overall economic resilience.

Technological Transformations

In the pursuit of efficiency and innovation, businesses are embracing rapid technological advancements. The integration of artificial intelligence, automation, and blockchain technologies is reshaping industries. Companies that adapt and leverage these technologies stand to gain a competitive edge, influencing the economic landscape significantly.

Sustainable Business Practices

Environmental, social, and governance (ESG) considerations are no longer peripheral concerns but integral to business strategies. Investors and consumers alike are prioritizing sustainability. In 2024, businesses adopting eco-friendly practices and demonstrating social responsibility are likely to thrive, contributing to a more sustainable economic future.

Remote Work Dynamics

The paradigm shift towards remote work, accelerated by the pandemic, is expected to persist. Companies are reevaluating traditional office structures and embracing flexible work arrangements. The implications of this shift extend beyond individual businesses to impact urban development, transportation, and the commercial real estate sector.

Supply Chain Resilience

Disruptions in global supply chains highlighted vulnerabilities that businesses must address. In 2024, building resilience into supply chain strategies will be a key focus. Diversification of suppliers, use of technology to enhance visibility, and a more localized approach to production are trends shaping the future of supply chain management.

Financial Market Volatility

Economic uncertainties often translate into fluctuations in financial markets. Investors will need to navigate a landscape of volatility, driven by factors such as inflation concerns, geopolitical tensions, and central bank policies. Strategic financial planning and risk management will be crucial for businesses and investors alike.

Consumer Behavior Shifts

Changing consumer behaviors, influenced by evolving preferences and digitalization, continue to shape markets. E-commerce, personalized experiences, and the demand for sustainable products are trends that businesses should closely monitor and adapt to in order to meet evolving consumer expectations.

Government Policies and Regulations

The regulatory environment plays a pivotal role in shaping economic landscapes. Businesses must stay abreast of evolving government policies, trade agreements, and regulatory frameworks. The ability to navigate and adapt to these changes will be crucial for sustained success.

Investment Opportunities

Amidst challenges, economic shifts often present unique investment opportunities. Identifying emerging sectors and understanding market dynamics can lead to strategic investments. As businesses evaluate growth prospects, aligning investment strategies with the evolving economic landscape becomes paramount.

In conclusion, the Economic Outlook 2024 for businesses is multifaceted, encompassing recovery, technological advancements, sustainability, and shifts in consumer behavior. Navigating this landscape requires adaptability, strategic planning, and a keen understanding of the interconnected factors influencing the global economy. For more insights on Economic Outlook 2024 Business, explore the link here.

Adaptable Company Dynamics: Navigating Change with Agility

![]()

Embracing Change as a Constant:

Adaptable Company Dynamics are crucial in an era where change is the only constant. This article explores how organizations can cultivate agility and resilience to navigate the dynamic business landscape successfully.

Building a Culture of Flexibility:

At the core of Adaptable Company Dynamics lies a culture of flexibility. This section delves into how companies can foster a mindset that embraces change and values adaptability. A flexible culture empowers employees to respond proactively to shifts in the market, technology, and customer expectations.

Within the realm of flexible cultures, Adaptable Company Dynamics serves as a valuable resource for companies seeking guidance on fostering adaptability within their organizational DNA.

Agile Leadership in Action:

Adaptable Company Dynamics require leadership that is agile and responsive. This part of the article explores the characteristics of agile leadership, such as quick decision-making, openness to feedback, and the ability to pivot strategies swiftly. Leaders who embody agility set the tone for a dynamic and responsive organizational culture.

Strategic Innovation for Market Resilience:

In the face of evolving market dynamics, companies with Adaptable Company Dynamics prioritize strategic innovation. This section discusses how organizations can cultivate innovation as a strategic imperative. By investing in research and development, staying attuned to market trends, and encouraging creative thinking, companies can position themselves for sustained success.

Investing in Employee Development:

Employees are at the forefront of driving organizational adaptability. This part of the article explores how companies can invest in employee development to enhance skills and competencies. Training programs, upskilling initiatives, and creating a culture of continuous learning contribute to a workforce that can readily adapt to changing circumstances.

Flexible Operational Structures:

Operational structures play a pivotal role in Adaptable Company Dynamics. This section delves into how organizations can design flexible operational frameworks that allow for scalability, efficiency, and rapid adjustments. Companies that can pivot their operations quickly are better equipped to respond to market fluctuations and seize emerging opportunities.

Leveraging Technology for Agility:

In the digital age, technology is a key enabler of adaptability. This part of the article explores how companies can leverage technology to enhance agility. From adopting cloud-based solutions to implementing data analytics for informed decision-making, technology plays a vital role in ensuring that organizations can adapt swiftly to changing circumstances.

Crisis Preparedness and Response Strategies:

Adaptable Company Dynamics include a proactive approach to crisis preparedness. This section examines how organizations can develop robust crisis response strategies. From scenario planning to establishing crisis communication protocols, companies can navigate unexpected challenges with resilience and agility.

Customer-Centric Adaptation:

Adaptability extends to meeting the evolving needs of customers. This part of the article explores how companies with Adaptable Company Dynamics prioritize customer-centric strategies. By actively seeking feedback, staying responsive to customer preferences, and innovating based on market demands, organizations can build lasting customer relationships.

Evolving with Regulatory Changes:

In industries subject to regulatory shifts, Adaptable Company Dynamics involve staying ahead of compliance requirements. This section discusses how organizations can monitor regulatory landscapes, anticipate changes, and adapt their operations to comply with evolving standards. Proactive regulatory compliance is integral to long-term sustainability.

Measuring and Improving Adaptability:

Adaptable Company Dynamics can be quantified and improved. This part of the article explores metrics and strategies for measuring organizational adaptability. By regularly assessing adaptability factors, companies can identify areas for improvement and implement targeted interventions to enhance their overall agility.

Conclusion:

In conclusion, Adaptable Company Dynamics are essential for organizations aiming to thrive in a rapidly changing business environment. Adaptable Company Dynamics serves as a guide for companies seeking to embrace change with agility, foster innovative cultures, and build resilience in the face of uncertainty. By prioritizing adaptability, companies can position themselves as leaders in their industries and navigate the complexities of the ever-evolving business landscape successfully.

Nurturing Entrepreneurial Business Values for Success

Nurturing Entrepreneurial Business Values for Success

In the dynamic landscape of business, success is often attributed not only to strategic planning and innovation but also to the cultivation of strong entrepreneurial values. These values form the bedrock upon which successful enterprises are built, fostering a culture that thrives amidst challenges and adapts to changing market dynamics.

Vision and Purpose: The Cornerstones of Entrepreneurial Success

Entrepreneurial ventures that stand the test of time are often grounded in a clear vision and purpose. A well-defined vision serves as a guiding star, providing direction and inspiring teams to work towards a common goal. Purpose, on the other hand, adds depth to the journey, aligning business objectives with meaningful contributions to society.

Integrity in Action: Building Trust and Credibility

Integrity is the backbone of any successful business. Upholding high ethical standards and being transparent in all dealings build trust and credibility with customers, employees, and stakeholders. Entrepreneurial ventures that prioritize integrity create enduring relationships and a positive reputation within the industry.

Embracing Innovation: A Catalyst for Growth

In the ever-evolving business landscape, innovation is not just a buzzword but a necessity. Entrepreneurs who foster a culture of creativity and curiosity within their teams are better positioned to adapt to market changes and stay ahead of the competition. Embracing innovation as a core value ensures continuous growth and relevance.

Resilience in the Face of Challenges

Entrepreneurial ventures are no strangers to challenges. Resilience, the ability to bounce back from setbacks, is a critical value for success. Cultivating a resilient mindset within the organization enables teams to navigate uncertainties, learn from failures, and emerge stronger on the other side.

Collaboration and Teamwork: Driving Collective Success

No business operates in isolation, and the value of collaboration cannot be overstated. Entrepreneurs who prioritize teamwork and foster a collaborative culture witness the synergistic effect of collective efforts. A cohesive team working towards shared goals is a powerful force that propels the business towards success.

Adaptability: Thriving in a Changing Landscape

In today’s fast-paced business environment, adaptability is a non-negotiable value. Entrepreneurs need to be agile and open to change, ready to pivot when necessary. Businesses that embed adaptability into their DNA can quickly adjust strategies, embrace new technologies, and stay relevant in an ever-changing market.

Customer-Centric Focus: Satisfying Needs and Building Loyalty

Successful entrepreneurs understand the importance of a customer-centric approach. Prioritizing customer needs, delivering exceptional experiences, and actively seeking feedback are crucial components of this value. Businesses that consistently exceed customer expectations build loyalty and secure a strong market position.

Social Responsibility: Making a Positive Impact

Entrepreneurial success goes beyond financial gains; it extends to the impact a business has on society. Values-driven entrepreneurs integrate social responsibility into their business models, contributing to community development, environmental sustainability, and ethical business practices.

Continuous Learning: A Commitment to Growth

Entrepreneurial journeys are marked by a commitment to continuous learning. Successful entrepreneurs and their teams embrace a growth mindset, staying curious and proactive in acquiring new skills and knowledge. This value not only enhances individual development but also contributes to the overall growth of the business.

Entrepreneurial Business Values in Action

Nurturing entrepreneurial business values is not a one-time effort but an ongoing commitment. It requires consistent reinforcement, clear communication, and leading by example. As businesses evolve, so too should their values, ensuring they remain relevant and effective in guiding the organization towards sustained success.

In conclusion, Entrepreneurial Business Values serve as the compass that directs businesses towards their goals. By fostering a culture rooted in vision, integrity, innovation, resilience, collaboration, adaptability, customer-centric focus, social responsibility, and continuous learning, entrepreneurs can build enterprises that stand resilient in the face of challenges and thrive in a competitive landscape.

To explore how these values are implemented in successful entrepreneurial ventures, visit Entrepreneurial Business Values. Learn from real-world examples and discover the transformative power of instilling these values in your business journey.

Social Business 2024 Engagement: Connecting in the Digital Age

Connecting in the Digital Age: Social Business 2024 Engagement

In the dynamic landscape of 2024, social business engagement is a crucial aspect of building meaningful connections in the digital realm. This article explores key strategies and trends that define social business engagement in 2024, offering insights to businesses seeking to enhance their online presence and connect with audiences effectively.

The Evolution of Social Media Platforms

Social media platforms continue to evolve, shaping the landscape of social business engagement. In 2024, platforms are not only diverse but also offer advanced features for businesses to connect with their audience. Social Business 2024 Engagement recognizes the importance of understanding platform dynamics, selecting the right channels, and adapting strategies to leverage the latest features for optimal engagement.

Content that Resonates with Audiences

In the digital age, content remains king. Social Business 2024 Engagement emphasizes the need for businesses to create content that resonates with their target audiences. Whether it’s informative articles, engaging visuals, or interactive videos, businesses must focus on delivering valuable and shareable content. Personalization and relevance are key factors in capturing audience attention in a crowded online space.

Engaging in Conversations and Community Building

Beyond one-way communication, social business engagement in 2024 involves actively engaging in conversations and community building. Social media is not just a broadcasting tool; it’s a platform for dialogue. Social Business 2024 Engagement encourages businesses to participate in discussions, respond to comments, and foster a sense of community around their brand. Building relationships goes hand-in-hand with building a strong online presence.

Influencer Collaboration and Partnerships

In the era of social media influencers, collaborations and partnerships play a significant role in social business engagement. Businesses can leverage the reach and credibility of influencers to connect with wider audiences. Social Business 2024 Engagement suggests that strategic collaborations with influencers aligned with brand values can amplify reach and enhance credibility, fostering a sense of trust among followers.

Real-Time Engagement and Customer Support

Instantaneous interactions are a hallmark of social business engagement in 2024. Businesses are expected to provide real-time responses to inquiries and feedback. Social Business 2024 Engagement highlights the importance of offering seamless customer support through social media channels. Quick and effective responses contribute to a positive customer experience, building trust and loyalty.

Utilizing Social Listening for Insights

Social listening tools have become invaluable for businesses looking to understand audience sentiments and gather insights. Social Business 2024 Engagement encourages businesses to leverage social listening to monitor brand mentions, track industry trends, and gain a deeper understanding of audience preferences. These insights can inform content strategies and enhance overall social business engagement.

Data Privacy and Transparent Communication

As data privacy concerns gain prominence, transparent communication is integral to social business engagement. Businesses must be clear and upfront about how they use customer data. Social Business 2024 Engagement emphasizes the importance of building trust by ensuring transparent communication regarding data privacy policies and practices. Trust is the foundation of a strong and enduring online relationship.

Gamification for Interactive Engagement

Innovative engagement strategies include gamification, turning social interactions into a game-like experience. Social Business 2024 Engagement explores how businesses can use gamification elements to make their online presence more interactive and enjoyable. Contests, quizzes, and challenges create a sense of fun and involvement, encouraging audiences to actively participate and share their experiences.

Measuring and Adapting with Analytics

The effectiveness of social business engagement strategies can be measured through analytics. Social Business 2024 Engagement emphasizes the importance of regularly analyzing social media metrics to gauge the impact of campaigns, understand audience behavior, and adapt strategies accordingly. Data-driven insights empower businesses to refine their approach and maximize engagement over time.

Conclusion: Building Meaningful Connections

In conclusion, social business engagement in 2024 is about building meaningful connections in the digital age. By understanding platform dynamics, creating compelling content, engaging in conversations, collaborating with influencers, providing real-time support, utilizing social listening, ensuring transparent communication, incorporating gamification, and leveraging analytics, businesses can foster authentic relationships and thrive in the ever-evolving world of social media.

For businesses seeking comprehensive guidance on optimizing social business engagement, the Social Business 2024 Engagement platform serves as a valuable resource. This platform offers insights, case studies, and practical strategies to help businesses connect with their audience effectively in the digital landscape. It acts as a link connecting businesses to the tools and knowledge needed for successful social business engagement.

Adaptive Leadership Development: Navigating Change Successfully

Adaptive Leadership Development: Navigating Change Successfully

In today’s dynamic business environment, where change is the only constant, leadership must evolve to meet the challenges effectively. Adaptive leadership development has emerged as a crucial strategy for navigating change successfully.

Understanding the Essence of Adaptive Leadership

Adaptive leadership goes beyond traditional leadership models, emphasizing the ability to respond and thrive in unpredictable situations. It involves fostering a culture that encourages innovation, resilience, and continuous learning.

Key Characteristics of Adaptive Leaders

Adaptive leaders possess distinct qualities that set them apart. They are agile decision-makers, comfortable with ambiguity, and capable of inspiring others amid uncertainty. These leaders prioritize collaboration and encourage their teams to embrace change as an opportunity for growth.

The Role of Continuous Learning in Adaptive Leadership

A cornerstone of adaptive leadership development is a commitment to continuous learning. Leaders must stay updated on industry trends, emerging technologies, and evolving market dynamics. This ongoing learning process equips them with the knowledge needed to make informed decisions in rapidly changing landscapes.

Building Resilience in Leadership

Change often brings challenges, and resilience is a crucial trait for leaders navigating uncertainties. Adaptive leadership development focuses on building resilience by fostering a mindset that views setbacks as learning opportunities and encourages leaders to adapt and persevere.

Effective Communication Strategies for Adaptive Leaders

Communication is central to successful leadership, especially in times of change. Adaptive leaders excel in transparent and empathetic communication, keeping their teams informed and engaged. This open communication fosters trust and enables a smoother transition through periods of uncertainty.

Creating an Adaptive Organizational Culture

Adaptive leadership extends beyond individual leaders to influence the entire organizational culture. Cultivating an environment that embraces change and encourages innovation is vital for long-term success. Adaptive leaders actively shape the culture, fostering a collective mindset that welcomes and adapts to change.

Challenges and Opportunities in Adaptive Leadership

While adaptive leadership brings numerous benefits, it is not without its challenges. Leaders may face resistance to change or encounter unforeseen obstacles. However, these challenges also present opportunities for growth and improvement, highlighting the importance of flexibility and adaptability.

Adaptive Leadership in Action

To illustrate the impact of adaptive leadership, consider a real-world example. A company facing industry disruption embraced adaptive leadership principles, reimagined its business model, and emerged stronger. This case study underscores the practical application and tangible benefits of adaptive leadership.

The Path Forward: Adaptive Leadership Development

As organizations recognize the value of adaptive leadership, investing in development programs becomes paramount. Training and mentorship opportunities help current and emerging leaders hone the skills needed to navigate change successfully.

In conclusion, adaptive leadership development is a strategic imperative for leaders seeking to thrive in an ever-changing world. Embracing the principles of adaptability, resilience, and continuous learning positions leaders to not only navigate change successfully but also to lead their teams to new heights.

To learn more about Adaptive Leadership Development and its transformative impact, visit copadosrefugiados.com.

Culinary Business 2024: Pioneering Innovators Shaping Tastes

Shaping Culinary Landscapes: Culinary Business 2024 Innovators

In the dynamic realm of culinary business, 2024 is witnessing a wave of innovation driven by visionary culinary entrepreneurs. These innovators are not only shaping tastes but redefining the entire culinary landscape. Let’s delve into the world of Culinary Business 2024 Innovators and explore the trends and transformative ideas that are leaving a flavorful impact.

Innovative Dining Concepts: Redefining the Culinary Experience

Culinary Business 2024 Innovators are introducing innovative dining concepts that go beyond traditional restaurant experiences. From immersive pop-up events to interactive dining spaces, these entrepreneurs are redefining how people engage with food. The emphasis is on creating memorable experiences that tantalize not only the taste buds but all the senses, turning dining into a form of art.

Tech Integration in Culinary Arts: The Rise of Smart Kitchens

The integration of technology is a hallmark of Culinary Business 2024 Innovators. Smart kitchens equipped with cutting-edge culinary tech are becoming the norm. From automated cooking processes to AI-assisted recipe creation, these innovators leverage technology to enhance efficiency, precision, and creativity in the culinary arts. The result is a fusion of culinary traditions with the latest advancements in kitchen tech.

Sustainability and Conscious Dining: Culinary Ethics in Focus

Culinary Business 2024 Innovators are placing a strong emphasis on sustainability and conscious dining. From sourcing ingredients locally to reducing food waste, these entrepreneurs are integrating ethical practices into their culinary ventures. The result is a growing awareness among consumers about the environmental and social impact of their food choices, leading to a more sustainable and responsible dining culture.

Culinary Fusion and Global Flavors: A Feast of Cultural Diversity

The global palate is expanding, thanks to Culinary Business 2024 Innovators who embrace culinary fusion and introduce diverse flavors. These innovators draw inspiration from cuisines around the world, creating fusion dishes that celebrate cultural diversity. The result is a culinary landscape where traditional boundaries dissolve, and each bite becomes a journey through a myriad of flavors and culinary traditions.

Artisanal and Craft Culinary Offerings: A Return to Handcrafted Excellence

In a world dominated by mass production, Culinary Business 2024 Innovators are championing artisanal and craft culinary offerings. From handcrafted chocolates to small-batch brewed beverages, these entrepreneurs focus on quality over quantity. This trend reflects a desire among consumers for unique, high-quality, and locally crafted culinary experiences that tell a story with each bite.

Virtual Dining Experiences: Culinary Adventures in the Digital Realm

Culinary Business 2024 Innovators are venturing into the digital realm with virtual dining experiences. Whether through virtual cooking classes, online tasting sessions, or immersive culinary events in virtual reality, these entrepreneurs are expanding the boundaries of culinary exploration. The digital space becomes a canvas for creativity, allowing food enthusiasts to embark on culinary adventures from the comfort of their homes.

Community-Centric Culinary Initiatives: Fostering Local Connections

Culinary Business 2024 Innovators recognize the importance of fostering local connections through community-centric initiatives. From collaborative chef partnerships to supporting local farmers and producers, these entrepreneurs contribute to the fabric of their communities. The result is a culinary landscape that celebrates local flavors, builds community bonds, and encourages a sense of shared culinary identity.

Elevated Culinary Education: Training the Next Generation

Culinary Business 2024 Innovators are not only chefs but educators, elevating culinary education to new heights. Culinary schools and academies led by these innovators focus on holistic training, incorporating not only technical skills but also creativity, sustainability, and business acumen. The goal is to nurture the next generation of culinary leaders who will continue to push the boundaries of the culinary arts.

Dynamic Culinary Entrepreneurship: Adapting to Trends and Changes

Culinary Business 2024 Innovators exemplify dynamic entrepreneurship by adapting to evolving trends and changes. From the latest food crazes to shifts in consumer preferences, these entrepreneurs stay ahead of the curve. The ability to embrace change and innovate in response to market dynamics ensures that their culinary ventures remain relevant and exciting.

Explore Culinary Business 2024 Innovators

Embark on a flavorful journey with Culinary Business 2024 Innovators at copadosrefugiados.com. Dive into insights, discover the latest culinary trends, and explore the impact of innovative ideas on the culinary landscape. Whether you’re a food enthusiast or aspiring culinary entrepreneur, explore the world of Culinary Business 2024 Innovators and savor the taste of culinary evolution.

Global Business 2024: Seamless Connectivity Strategies

Navigating the Future: Strategies for Seamless Global Business Connectivity in 2024

In the rapidly evolving landscape of global business, connectivity is at the forefront of success. As we step into 2024, businesses are redefining their strategies to ensure seamless connectivity on a global scale.

The Digital Backbone: Leveraging Technology for Connectivity

In the digital age, technology serves as the backbone for global business connectivity. Companies are investing in advanced communication tools, cloud computing, and collaborative platforms to bridge geographical gaps. The adoption of cutting-edge technology facilitates real-time communication and data sharing, fostering seamless connectivity across borders.

Global Networking: Building Strong Partnerships

Networking has always been a cornerstone of successful business, and in 2024, it takes on a global dimension. Establishing strong partnerships with businesses around the world is crucial for expanding reach and accessing new markets. Collaborative efforts and shared resources enhance the overall connectivity, creating a web of opportunities for growth.

Cultural Intelligence: Enhancing Cross-Cultural Connectivity

Understanding and respecting diverse cultures is paramount for effective global business connectivity. Cultural intelligence goes beyond language barriers; it involves comprehending social norms, business etiquette, and values. Businesses that prioritize cultural intelligence foster better relationships, ensuring smooth communication and collaboration in a multicultural business environment.

Agile Supply Chains: Ensuring Uninterrupted Connectivity

In the realm of global business, supply chains play a pivotal role in connectivity. An agile and resilient supply chain is essential for ensuring uninterrupted connectivity, especially in the face of unforeseen challenges such as geopolitical shifts or natural disasters. Businesses are adopting advanced supply chain technologies to enhance efficiency and responsiveness.

Data Security: Safeguarding Global Connectivity

As businesses become more interconnected, the importance of data security cannot be overstated. Safeguarding sensitive information is a critical aspect of ensuring trust and reliability in global business connectivity. Companies are implementing robust cybersecurity measures to protect data integrity and prevent unauthorized access, thereby maintaining the resilience of their global networks.

Remote Work Revolution: Redefining Workplace Connectivity

The global shift toward remote work has redefined the concept of workplace connectivity. With teams distributed across various locations, businesses are leveraging virtual collaboration tools and project management platforms. The ability to seamlessly connect and collaborate, regardless of physical distance, has become a key factor in sustaining productivity and innovation.

Adapting to Regulatory Changes: Navigating Legal Connectivity

The regulatory landscape in global business is dynamic, with changes that impact cross-border transactions and operations. Adapting to these regulatory shifts is crucial for maintaining legal connectivity. Businesses are closely monitoring and responding to changes in trade agreements, compliance standards, and other legal frameworks to ensure seamless and compliant operations.

Strategic Communication: Aligning Messaging for Global Audiences

Effective communication is a linchpin of global business connectivity. Companies are refining their communication strategies to align messaging with the cultural nuances and preferences of diverse global audiences. Tailoring marketing campaigns, customer support, and brand messaging to resonate with different regions enhances the overall connectivity and market penetration.

Investing in Sustainable Practices: Long-Term Connectivity

Sustainability is emerging as a key consideration in global business strategies. Companies are increasingly adopting sustainable practices not only for environmental responsibility but also as a means of ensuring long-term connectivity. Building a reputation for corporate responsibility enhances relationships with environmentally conscious partners and customers, contributing to sustained global connectivity.

Seamless Global Business Connectivity in 2024 and Beyond

In conclusion, achieving seamless global business connectivity in 2024 requires a multifaceted approach. From leveraging technology and building strong partnerships to embracing cultural intelligence and ensuring data security, businesses are navigating a complex landscape. To stay at the forefront of global business connectivity, explore CopadosRefugiados.com for valuable insights and resources that can shape your strategies for the future.

Agile Triumph: Strategies for Business Success

Agile Triumph: Strategies for Business Success

In today’s rapidly evolving business landscape, agility has become a crucial factor for success. Companies that can adapt quickly to change and respond nimbly to challenges are better positioned to thrive. Embracing agile methodologies goes beyond project management; it’s a mindset that can transform the way businesses operate.

The Essence of Agile Methodology

At the core of agile methodology lies the principle of iterative development. Instead of rigidly adhering to long-term plans, agile businesses break down projects into smaller, manageable tasks. This iterative approach allows for continuous improvement, fostering adaptability and responsiveness to market dynamics.

Collaboration and Cross-Functional Teams

Agile success is not solely about processes; it’s about people and collaboration. Agile methodologies emphasize the importance of cross-functional teams working together towards a common goal. Communication flows seamlessly, and barriers between departments are minimized, promoting a more holistic and integrated approach to problem-solving.

Customer-Centric Focus

One of the key pillars of agile methodology is a relentless focus on the customer. By regularly gathering feedback and incorporating it into the development process, businesses can ensure that their products or services meet customer expectations. This customer-centric approach not only enhances satisfaction but also helps in building products that truly resonate with the target audience.

Adapting to Change in Real-Time

In a dynamic business environment, change is inevitable. Agile businesses are not just prepared for change; they embrace it. The ability to adapt in real-time to market shifts, technological advancements, or unforeseen challenges is a defining characteristic of agile success. This flexibility allows companies to stay ahead in a competitive landscape.

Measuring Success with Key Performance Indicators (KPIs)

Agile methodologies emphasize the importance of measurable outcomes. Key Performance Indicators (KPIs) provide valuable insights into the effectiveness of agile practices. Whether it’s reducing time-to-market, improving customer satisfaction, or enhancing team collaboration, KPIs serve as benchmarks for evaluating and refining agile strategies.

Continuous Learning and Improvement

Agile is not a one-size-fits-all solution; it’s a continuous journey of learning and improvement. Regular retrospectives and feedback loops enable teams to reflect on their processes and identify areas for enhancement. This commitment to continuous improvement ensures that agile practices evolve in tandem with the changing needs of the business.

Agile Business Success in Action

To witness the transformative power of agile methodologies, look no further than CopadosRefugiados.com. This innovative platform has embraced agile principles to create a seamless and user-friendly experience for refugees seeking support. By leveraging agile strategies, CopadosRefugiados.com has rapidly adapted to the evolving needs of its users, showcasing the tangible benefits of agility in action.

For more insights into Agile Business Success, visit CopadosRefugiados.com. Learn how this platform’s commitment to agility has not only improved its services but has also made a meaningful impact on the lives of refugees.

Conclusion

Agile triumph in business is not just about adopting a set of practices; it’s a holistic approach that transforms the entire organizational culture. By prioritizing collaboration, adaptability, and continuous improvement, businesses can navigate the complexities of the modern market landscape and emerge victoriously. Embrace agility, and unlock the true potential of your business.

Business 2024 Culinary Trends: Innovations Shaping the Food Industry

Innovations Shaping the Food Industry: Business 2024 Culinary Trends

The culinary landscape is evolving rapidly in 2024, driven by consumer preferences, technological advancements, and global influences. This article explores the key trends shaping the business side of the culinary world in 2024, from innovative menu offerings to sustainability initiatives.

1. Culinary Technology Integration

Businesses in 2024 are leveraging technology to enhance various aspects of culinary operations. From smart kitchens with automated cooking processes to advanced food delivery systems, Culinary Technology Integration is at the forefront. This trend aims to streamline processes, improve efficiency, and meet the growing demand for convenient and tech-savvy dining experiences.

2. Plant-Based Revolution in Business

The Plant-Based Revolution continues to gain momentum, with businesses incorporating more plant-based options into their menus. Whether driven by environmental concerns, health considerations, or shifting consumer preferences, the plant-based trend is reshaping the culinary landscape. Businesses are exploring creative ways to elevate plant-based dishes, making them appealing to a broader audience.

3. Hyper-Local Sourcing Practices

Business 2024 Culinary Trends emphasize Hyper-Local Sourcing Practices, reflecting a commitment to sustainability and supporting local communities. Restaurants and food businesses are increasingly sourcing ingredients from nearby farms and producers, reducing their carbon footprint and providing customers with fresh, locally sourced culinary experiences. This trend aligns with the growing demand for transparency and ethical business practices.

4. Personalized Dining Experiences

Customization and Personalization are taking center stage in the culinary world. Businesses are offering personalized dining experiences, allowing customers to tailor their meals to individual preferences. From customizable menus to personalized nutrition plans, this trend caters to the desire for unique and tailored culinary journeys, enhancing customer satisfaction and loyalty.

5. Fusion of Culinary Cultures

In a globalized world, the Fusion of Culinary Cultures is a prominent trend. Businesses are blending diverse culinary traditions, creating unique and innovative flavor profiles. This trend not only caters to adventurous palates but also celebrates cultural diversity, providing a platform for chefs to showcase their creativity by marrying different culinary influences in a single dish.

6. Innovative Food Presentation and Plating

Culinary aesthetics are taking a front seat with Innovative Food Presentation and Plating. Businesses recognize the impact of visual appeal on the overall dining experience. From artistic plating techniques to interactive and experiential presentations, this trend reflects the importance of aesthetics in creating memorable and shareable culinary moments.

7. Rise of Virtual Restaurants

The Rise of Virtual Restaurants is transforming the culinary landscape. With the rise of online food delivery platforms, businesses are capitalizing on the virtual model. Virtual restaurants operate without a traditional brick-and-mortar setting, focusing solely on online orders and delivery. This trend allows for greater flexibility and reduced operational costs.

8. Sustainable and Eco-Friendly Practices

Sustainability is not just a buzzword; it’s a core principle guiding Business 2024 Culinary Trends. From eco-friendly packaging to waste reduction initiatives, businesses are adopting Sustainable and Eco-Friendly Practices. Consumers are increasingly mindful of the environmental impact of their dining choices, and businesses that prioritize sustainability gain a competitive edge.

9. Culinary Education and Food Experiences

Businesses are recognizing the value of Culinary Education and Food Experiences as a way to engage customers. This trend involves hosting cooking classes, food workshops, and immersive dining experiences. It not only provides an additional revenue stream but also fosters a deeper connection between businesses and their customers, creating lasting memories.

10. Integration of Artificial Intelligence

Artificial Intelligence (AI) is making its mark on the culinary world, shaping Business 2024 Culinary Trends. From AI-powered recipe creation to predictive analytics for menu planning, businesses are leveraging AI to enhance efficiency and innovation. This trend reflects the industry’s embrace of cutting-edge technology to stay ahead in a competitive market.

Culinary Trends Steering Business Success

For businesses seeking insights into the ever-evolving culinary landscape, the Business 2024 Culinary Trends platform serves as a valuable resource. This platform offers a curated collection of trends, case studies, and expert perspectives to guide businesses in navigating the dynamic world of culinary innovation. It acts as a link connecting businesses to the knowledge and strategies needed for success in the ever-evolving food industry.

Conclusion: Navigating the Culinary Future

In conclusion, the business side of the culinary world in 2024 is marked by innovation, sustainability, and a deep understanding of consumer preferences. As businesses embrace technology, cater to evolving tastes, and prioritize sustainability, they position themselves for success in a competitive and dynamic industry. Business 2024 Culinary Trends reflect not only the current state of the culinary landscape but also a roadmap for navigating the future of food business.

Dynamic Workplace: Explore the Impact of Flexible Schedules

In the ever-evolving landscape of modern business, companies are constantly seeking innovative ways to enhance productivity, foster employee engagement, and stay ahead of the competition. One of the key strategies gaining traction is the implementation of dynamic workplace practices. These practices go beyond traditional work setups, embracing flexibility, collaboration, and adaptability. In this article, we will explore the various facets of dynamic workplace practices and their impact on both employees and organizations.

Embracing Flexibility:

The cornerstone of dynamic workplace practices is flexibility. This extends beyond the conventional 9-to-5 office hours, allowing employees to choose when and where they work. Remote work has become a central component of this flexibility, providing employees with the autonomy to create a work environment that suits their needs. This shift from a rigid schedule to a more adaptable one has been instrumental in improving work-life balance and reducing burnout.

Fostering Collaboration:

Dynamic workplaces emphasize collaboration as a driving force for innovation and success. Traditional hierarchical structures are giving way to more fluid and interconnected teams, where communication flows seamlessly. Collaborative tools and technologies play a crucial role in enabling employees to work together efficiently, regardless of their physical location. This approach not only enhances productivity but also cultivates a sense of camaraderie among team members.

Adopting Agile Methodologies:

Agility is at the heart of dynamic workplace practices. Companies are increasingly adopting agile methodologies, originally derived from the software development realm, to enhance project management and decision-making processes. Agile practices promote iterative and incremental development, allowing teams to respond quickly to changing priorities and customer feedback. This adaptability is crucial in today’s fast-paced business environment.

Investing in Employee Well-being:

A dynamic workplace prioritizes the well-being of its employees. Recognizing that happy and healthy employees are more productive, companies are implementing wellness programs and initiatives. These can include mental health support, fitness incentives, and flexible healthcare options. The focus is on creating an environment where employees feel supported, valued, and able to thrive both personally and professionally.

Navigating Digital Transformation:

Dynamic workplaces are at the forefront of digital transformation. Embracing cutting-edge technologies not only streamlines operations but also enhances the overall employee experience. From cloud-based collaboration tools to artificial intelligence-driven automation, companies are leveraging technology to create more efficient and engaging work environments. This digital evolution is essential for staying competitive in today’s tech-driven landscape.

As organizations continue to embrace dynamic workplace practices, it’s crucial to stay informed and adapt to the latest trends. One noteworthy resource for companies exploring dynamic workplace solutions is Dynamic Workplace Practices. This platform offers valuable insights, case studies, and best practices for creating a dynamic and thriving workplace.

Cultivating a Culture of Continuous Learning:

In dynamic workplaces, the pursuit of knowledge is a continuous journey. Companies are investing in learning and development programs to upskill their workforce and stay ahead of industry trends. This commitment to ongoing education not only benefits individual employees but also positions the organization as a leader in its field. A culture of continuous learning fosters innovation and ensures that employees are well-equipped to tackle new challenges.

Measuring and Adapting:

Dynamic workplace practices are not static; they require continuous evaluation and adaptation. Companies are leveraging data analytics to measure the effectiveness of these practices and gather insights into employee performance and satisfaction. Regular feedback loops and surveys help organizations understand what is working well and where improvements can be made. This iterative approach ensures that the workplace remains dynamic and responsive to the evolving needs of the workforce.

In conclusion, dynamic workplace practices are reshaping the way companies operate and engage with their employees. The shift towards flexibility, collaboration, agility, and employee well-being is not just a trend but a strategic imperative for success in the modern business landscape. By embracing these practices, companies can create a work environment that attracts top talent, fosters innovation, and ultimately drives sustainable growth.

Business 2024: Global Growth Strategies Unleashed

Unleashing Global Potential: Business 2024 International Expansion

In the dynamic landscape of 2024, businesses are seizing the opportunity to expand their horizons and reach new markets on an international scale. International expansion has become a strategic imperative, and organizations are adopting innovative approaches to thrive in the global arena.

Navigating Global Dynamics: Business Strategies in 2024

The international business landscape in 2024 is marked by diverse challenges and opportunities. Organizations are developing comprehensive strategies that consider geopolitical factors, cultural nuances, and economic trends. The ability to navigate these global dynamics is crucial for successful international expansion.

Strategic Market Entry: Tailoring Approaches for Success

Entering a new market requires a strategic approach tailored to the specific characteristics of each region. In 2024, businesses are investing in thorough market research, understanding consumer behavior, and adapting their products or services to meet the unique demands of different international markets.

E-commerce as a Global Gateway: Expanding Digital Frontiers

E-commerce continues to be a driving force behind international expansion in 2024. Businesses are leveraging digital platforms to reach global audiences, allowing consumers from different parts of the world to access and purchase products or services. The digital landscape has become a powerful gateway for global business expansion.

Cultural Intelligence: Building Bridges Across Borders

Cultural intelligence is a key asset in the toolkit of businesses expanding internationally. In 2024, organizations are placing emphasis on understanding and respecting cultural diversity. From marketing strategies to customer interactions, businesses are building bridges across borders by embracing cultural nuances and fostering positive relationships.

Collaborative Partnerships: Forging Alliances for Global Success

Collaborative partnerships are emerging as a strategic enabler for international expansion. In 2024, businesses are forging alliances with local partners, leveraging their expertise and networks to navigate unfamiliar markets. Collaborations not only facilitate market entry but also contribute to the development of a global business ecosystem.

Regulatory Compliance: Navigating Legal Landscapes

Navigating the legal landscapes of different countries is a critical aspect of international expansion. In 2024, businesses are prioritizing regulatory compliance to ensure a smooth entry into new markets. This includes understanding local laws, trade regulations, and industry-specific compliance requirements.

Risk Mitigation Strategies: Safeguarding Global Ventures

International expansion inherently involves risks, and businesses in 2024 are implementing robust risk mitigation strategies. This includes thorough risk assessments, contingency planning, and insurance measures to safeguard against unexpected challenges. Proactive risk management is essential for the sustained success of global ventures.

Technology as a Global Enabler: Connectivity in the Digital Age

The role of technology as a global enabler cannot be overstated in 2024. Businesses leverage advanced technologies for seamless communication, efficient logistics, and real-time data analysis. The digital age has transformed international expansion, making it more accessible and manageable for businesses of all sizes.

Sustainable Global Practices: Responsible Business on a Global Scale

Sustainability is a cornerstone of responsible global business practices. In 2024, businesses expanding internationally are integrating sustainability into their strategies. This includes eco-friendly supply chains, ethical business practices, and corporate social responsibility initiatives that contribute positively to the global communities they engage with.

Explore Business 2024 International Expansion

For insights and resources on Business 2024 International Expansion, visit copadosrefugiados.com. Discover how businesses are successfully navigating the complexities of international expansion and unlocking new possibilities on a global scale. Whether you’re a business leader or an enthusiast, explore the exciting landscape of international business in 2024.

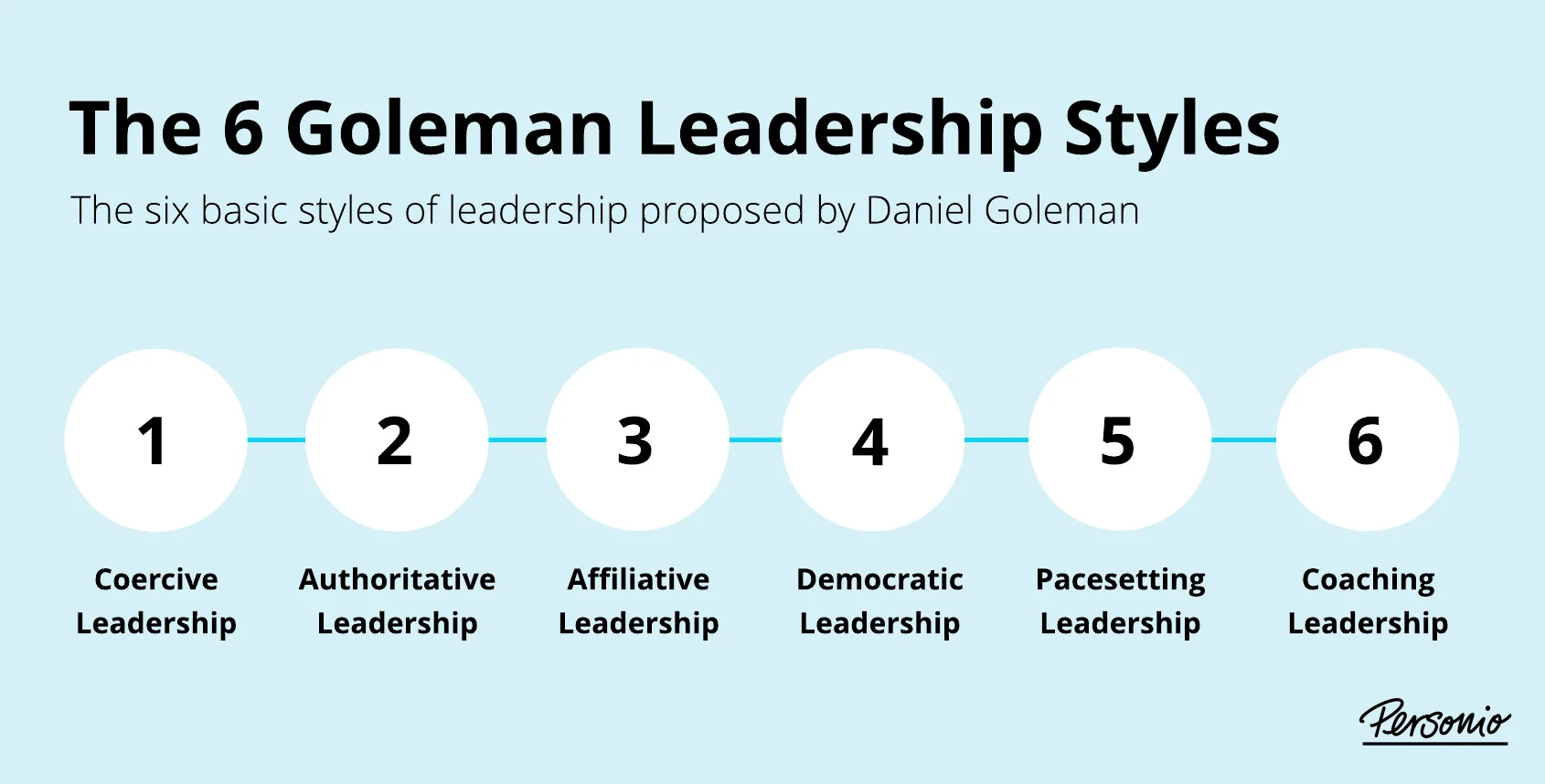

Modern Leadership Styles: Navigating the Evolving Business Landscape

Adapting to the Evolving Business Landscape:

In the dynamic and ever-changing world of business, leaders must adopt Modern Leadership Styles to navigate the challenges and opportunities presented by the evolving landscape. This article explores the key elements that define modern leadership and how they contribute to organizational success.

Embracing Agility and Flexibility:

Modern Leadership Styles prioritize agility and flexibility in decision-making and organizational strategies. Leaders who embrace change and adapt to new circumstances foster a culture of innovation and resilience. The ability to pivot swiftly in response to market dynamics and unexpected challenges is a hallmark of effective modern leadership.

Within the realm of adaptive leadership, Modern Leadership Styles serves as a resource for leaders looking to enhance their skills and stay attuned to the demands of the contemporary business environment.

Promoting Inclusivity and Diversity:

Inclusion and diversity are integral aspects of modern leadership. Leaders who foster an inclusive workplace, embracing individuals from diverse backgrounds and perspectives, contribute to a richer and more innovative organizational culture. This section explores how modern leaders champion equality, equity, and diversity to create environments where every voice is heard and valued.

Encouraging Collaborative Decision-Making: